- Understanding Power of Attorney in Connecticut

- What is Power of Attorney?

- Types of Power of Attorney in Connecticut

- Importance of Power of Attorney

- Steps to Obtain Power of Attorney in Connecticut

- Determine the Type of Power of Attorney You Need

- Choose an Agent

- Question-answer:

- What is a power of attorney?

- Why would I need a power of attorney in Connecticut?

- Who can be my agent in Connecticut?

- What powers can I grant to my agent in Connecticut?

- What is a power of attorney?

Obtaining power of attorney in Connecticut can be a crucial step in ensuring that your affairs are properly managed in the event that you become incapacitated or unable to make decisions for yourself. Whether you are planning for the future or facing a sudden emergency, having power of attorney can provide you with peace of mind and the assurance that your wishes will be respected.

So, how do you go about getting power of attorney in CT? This step-by-step guide will walk you through the process, from understanding the different types of power of attorney to filing the necessary paperwork and appointing a trusted individual to act on your behalf.

Step 1: Determine the Type of Power of Attorney You Need

There are several types of power of attorney in Connecticut, each with its own specific purpose and scope. The most common types include:

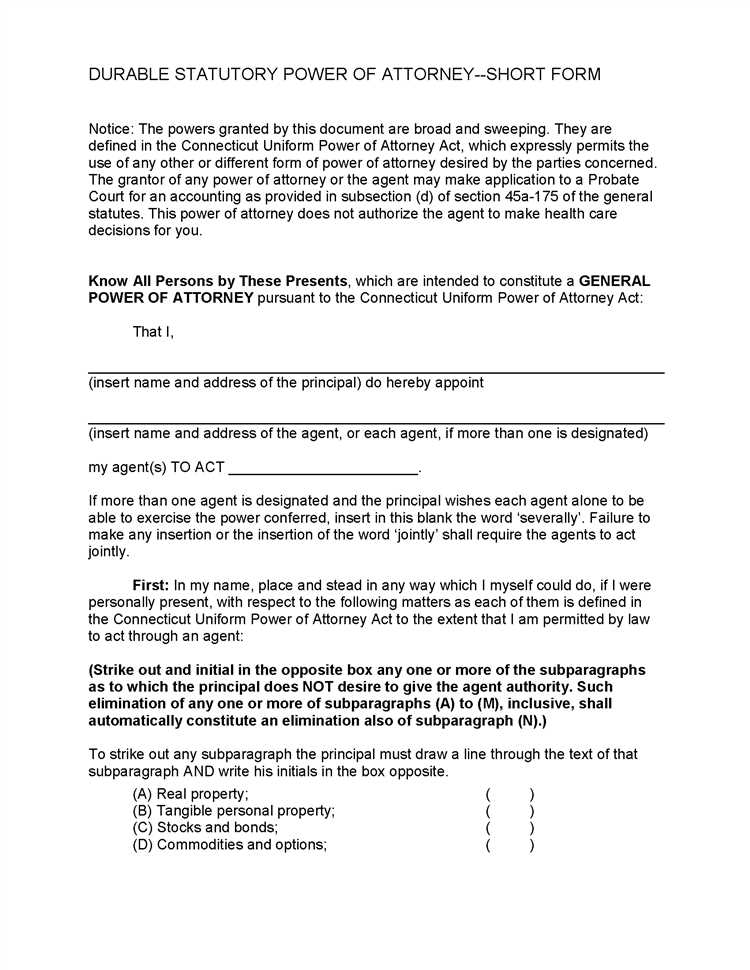

- General Power of Attorney: This grants broad authority to the appointed individual to make financial and legal decisions on your behalf.

- Limited Power of Attorney: This grants specific authority for a limited period of time or for a specific purpose, such as selling a property or managing investments.

- Healthcare Power of Attorney: This grants authority to make medical decisions on your behalf if you are unable to do so.

Step 2: Choose Your Agent

Once you have determined the type of power of attorney you need, you will need to choose a trusted individual to act as your agent. This person should be someone who understands your wishes and will act in your best interests. It is important to have an open and honest conversation with your chosen agent to ensure that they are willing and able to take on this responsibility.

Step 3: Draft and Sign the Power of Attorney Document

Next, you will need to draft the power of attorney document. This document should clearly state your intentions and the powers you are granting to your agent. It is recommended to seek the assistance of an attorney to ensure that the document is legally valid and meets all the requirements of Connecticut law. Once the document is drafted, it must be signed and notarized in the presence of a notary public.

Step 4: File the Power of Attorney Document

After the power of attorney document is signed and notarized, it is important to file it with the appropriate authorities. In Connecticut, this typically involves filing the document with the town clerk’s office in the town where you reside. Filing the document ensures that it is on record and can be easily accessed when needed.

Step 5: Communicate Your Wishes

Finally, it is important to communicate your wishes to your agent and any other relevant parties. This includes discussing your healthcare preferences, financial goals, and any specific instructions you have regarding the use of your power of attorney. Regular communication with your agent will help ensure that they are aware of your wishes and can act accordingly.

By following these steps, you can obtain power of attorney in Connecticut and have the peace of mind knowing that your affairs will be properly managed in the event of incapacity or inability to make decisions for yourself.

Understanding Power of Attorney in Connecticut

Power of Attorney is a legal document that allows an individual, known as the principal, to appoint another person, known as the agent or attorney-in-fact, to make decisions and act on their behalf. In Connecticut, the Power of Attorney grants the agent the authority to handle various financial, legal, and healthcare matters on behalf of the principal.

The Power of Attorney in Connecticut is governed by the Connecticut Uniform Power of Attorney Act. This act outlines the requirements and provisions for creating and executing a valid Power of Attorney document in the state.

It is important to understand that the Power of Attorney is a powerful tool that grants significant authority to the agent. Therefore, it is crucial to carefully consider who you appoint as your agent and clearly define their powers and limitations in the Power of Attorney document.

There are different types of Power of Attorney in Connecticut, including general, limited, durable, and healthcare Power of Attorney. Each type serves a specific purpose and grants different levels of authority to the agent.

The general Power of Attorney grants the agent broad powers to handle various financial and legal matters on behalf of the principal. However, this authority terminates if the principal becomes incapacitated or unable to make decisions.

The limited Power of Attorney, on the other hand, grants the agent specific powers for a limited period or specific transaction. Once the transaction or period ends, the agent’s authority also terminates.

The durable Power of Attorney remains in effect even if the principal becomes incapacitated or unable to make decisions. This type of Power of Attorney is often used for long-term planning and allows the agent to handle the principal’s affairs in the event of their incapacity.

The healthcare Power of Attorney, also known as a medical Power of Attorney or healthcare proxy, grants the agent the authority to make healthcare decisions on behalf of the principal if they are unable to do so themselves. This includes decisions about medical treatment, end-of-life care, and other healthcare-related matters.

Understanding the different types of Power of Attorney in Connecticut is essential to ensure that you choose the right type for your specific needs and circumstances. It is recommended to consult with an attorney experienced in estate planning and Power of Attorney laws to ensure that your document is valid and meets your requirements.

What is Power of Attorney?

Power of Attorney is a legal document that grants someone the authority to act on behalf of another person in making financial and legal decisions. The person granting the power is known as the principal, while the person receiving the power is called the agent or attorney-in-fact.

Power of Attorney can be useful in various situations, such as when someone becomes incapacitated and is unable to make decisions for themselves, or when someone needs assistance managing their affairs due to age, illness, or other circumstances.

By granting Power of Attorney, the principal gives the agent the power to handle financial transactions, sign legal documents, make healthcare decisions, and perform other tasks specified in the document. The extent of the agent’s authority can be limited or broad, depending on the principal’s wishes.

It’s important to note that Power of Attorney is a legal document that should be carefully considered and executed. It is crucial to choose a trustworthy and responsible agent who will act in the best interests of the principal. Additionally, the document should be properly drafted and signed in accordance with the laws of the state of Connecticut.

Overall, Power of Attorney is a valuable tool that allows individuals to plan for the future and ensure that their affairs will be handled by someone they trust. It provides peace of mind and can help avoid potential conflicts or complications that may arise if someone becomes unable to make decisions on their own.

Types of Power of Attorney in Connecticut

When it comes to obtaining power of attorney in Connecticut, it is important to understand the different types available. Each type of power of attorney grants different levels of authority to the appointed agent. Here are the main types of power of attorney in Connecticut:

| Type | Description |

|---|---|

| General Power of Attorney | This type of power of attorney grants broad authority to the agent, allowing them to make financial and legal decisions on behalf of the principal. It is typically used when the principal wants to give someone the authority to act on their behalf in various matters. |

| Limited Power of Attorney | A limited power of attorney grants the agent specific powers and authority for a limited period of time or for specific transactions. It is often used when the principal needs assistance with a particular task or when they are unable to handle certain matters themselves. |

| Healthcare Power of Attorney | A healthcare power of attorney, also known as a medical power of attorney, grants the agent the authority to make healthcare decisions on behalf of the principal. This type of power of attorney is used when the principal is unable to make medical decisions due to incapacity or illness. |

| Springing Power of Attorney | A springing power of attorney becomes effective only when a specific event or condition occurs, such as the incapacity of the principal. It allows the agent to act on behalf of the principal only when the specified condition is met. |

It is important to carefully consider the type of power of attorney that best suits your needs and circumstances. Consulting with an attorney experienced in estate planning and power of attorney matters can help ensure that you choose the right type of power of attorney and that it is properly executed.

Importance of Power of Attorney

Power of Attorney is a legal document that grants someone the authority to act on your behalf in financial and legal matters. It is an essential tool that can provide peace of mind and protection for individuals, especially in situations where they are unable to make decisions or handle their affairs due to illness, disability, or absence.

Having a Power of Attorney in place ensures that your interests are safeguarded and that someone you trust is appointed to make decisions on your behalf. This can be particularly important in situations where you become incapacitated or unable to communicate your wishes.

By granting someone Power of Attorney, you are giving them the ability to manage your finances, pay bills, make healthcare decisions, and handle other important matters. This can be crucial in ensuring that your affairs are properly managed and that your best interests are always taken into account.

Without a Power of Attorney, your loved ones may face significant challenges and obstacles when trying to handle your affairs. They may need to go through a lengthy and expensive legal process to gain the authority to act on your behalf, which can cause unnecessary stress and delays.

Additionally, having a Power of Attorney can help prevent potential disputes and conflicts among family members. By clearly outlining your wishes and appointing a trusted individual as your agent, you can minimize the likelihood of disagreements and ensure that your affairs are handled smoothly.

Overall, the importance of Power of Attorney cannot be overstated. It is a crucial legal document that provides protection, peace of mind, and ensures that your wishes are respected and carried out. It is recommended that everyone, regardless of age or health status, consider creating a Power of Attorney to ensure that their affairs are properly managed in any situation.

Steps to Obtain Power of Attorney in Connecticut

Obtaining power of attorney in Connecticut involves several important steps. By following these steps, you can ensure that you have the necessary legal authority to make decisions on behalf of another person.

Step 1: Understand the Purpose

Before proceeding with obtaining power of attorney, it is crucial to understand its purpose. Power of attorney is a legal document that grants someone else the authority to act on your behalf in financial, legal, or medical matters. It is important to have a clear understanding of the responsibilities and limitations associated with this role.

Step 2: Determine the Type of Power of Attorney You Need

There are different types of power of attorney in Connecticut, each serving a specific purpose. It is essential to determine the type of power of attorney that best suits your needs. Some common types include general power of attorney, limited power of attorney, durable power of attorney, and healthcare power of attorney.

Step 3: Choose an Agent

Once you have determined the type of power of attorney you need, you must choose an agent. An agent is the person who will be granted the authority to act on your behalf. It is important to select someone you trust and who is capable of handling the responsibilities associated with power of attorney.

Step 4: Draft the Power of Attorney Document

After selecting an agent, the next step is to draft the power of attorney document. This document should clearly outline the powers and limitations granted to the agent. It is recommended to seek legal assistance to ensure that the document is properly drafted and meets all legal requirements.

Step 5: Execute the Power of Attorney Document

Once the power of attorney document is drafted, it must be executed according to Connecticut state laws. This typically involves signing the document in the presence of a notary public or witnesses. It is important to follow the proper execution procedures to ensure the validity of the power of attorney.

Step 6: Distribute Copies of the Power of Attorney Document

After the power of attorney document is executed, it is important to distribute copies to relevant parties. This may include banks, healthcare providers, and other institutions that may require proof of the agent’s authority. Keeping copies of the document for your records is also recommended.

Step 7: Review and Update as Needed

Lastly, it is important to regularly review and update the power of attorney document as needed. Circumstances may change, and it may be necessary to modify or revoke the power of attorney. It is recommended to consult with legal professionals to ensure that any changes are properly executed and documented.

By following these steps, you can obtain power of attorney in Connecticut and have the necessary legal authority to make decisions on behalf of another person.

Determine the Type of Power of Attorney You Need

Before obtaining a power of attorney in Connecticut, it is important to determine the specific type of power of attorney that suits your needs. There are different types of power of attorney, each with its own purpose and scope.

One common type of power of attorney is the general power of attorney. This grants broad powers to the agent, allowing them to make decisions and act on your behalf in various matters. It is important to note that a general power of attorney becomes invalid if the principal becomes incapacitated.

Another type is the limited power of attorney, which grants specific powers to the agent for a limited period of time or for a specific purpose. This can be useful if you need someone to handle a specific task or transaction on your behalf, such as signing documents or managing your finances while you are out of the country.

A durable power of attorney is another option, which remains in effect even if the principal becomes incapacitated. This can be important for individuals who want to ensure that their affairs are taken care of in the event of a disability or illness.

Additionally, there is a healthcare power of attorney, which specifically grants the agent the authority to make healthcare decisions on your behalf if you are unable to do so. This can include decisions about medical treatment, end-of-life care, and other healthcare-related matters.

Lastly, there is a springing power of attorney, which only becomes effective under certain conditions specified in the document. For example, it may only come into effect if the principal becomes incapacitated or if a specific event occurs.

When determining the type of power of attorney you need, consider your specific circumstances and what powers you want to grant to your agent. Consulting with an attorney can also be helpful in understanding the different types of power of attorney and choosing the one that best suits your needs.

Choose an Agent

Choosing the right agent is a crucial step in obtaining power of attorney in Connecticut. An agent is the person who will be responsible for making decisions on your behalf when you are unable to do so. It is important to select someone who is trustworthy, reliable, and capable of handling the responsibilities that come with being an agent.

When choosing an agent, consider the following:

- Trustworthiness: You should choose someone who you trust implicitly. This person will have access to your financial and legal matters, so it is essential that they act in your best interests.

- Reliability: Your agent should be someone who is dependable and responsible. They should be able to handle the responsibilities that come with being an agent, such as managing your finances and making important decisions on your behalf.

- Capability: It is important to choose someone who is capable of handling the tasks associated with being an agent. They should have a good understanding of your financial and legal matters and be able to make informed decisions on your behalf.

- Availability: Your agent should be someone who is readily available and accessible. They should be able to respond to your needs and act on your behalf in a timely manner.

- Communication: It is important to choose someone who is a good communicator. Your agent should be able to effectively communicate with you, as well as with other individuals involved in your financial and legal matters.

Once you have identified a potential agent, it is important to have a conversation with them about your expectations and the responsibilities that come with being an agent. Make sure they are willing to take on this role and understand the importance of acting in your best interests.

It is also a good idea to have a backup agent in case your primary agent is unable or unwilling to fulfill their duties. This will ensure that someone is always available to act on your behalf if needed.

Choosing the right agent is a critical step in obtaining power of attorney in Connecticut. Take the time to carefully consider your options and select someone who you trust and who is capable of handling the responsibilities that come with being an agent.

Question-answer:

What is a power of attorney?

A power of attorney is a legal document that allows someone to make decisions and act on behalf of another person, known as the principal, in financial and legal matters.

Why would I need a power of attorney in Connecticut?

You may need a power of attorney in Connecticut if you want to appoint someone to handle your financial affairs or make legal decisions on your behalf in case you become incapacitated or unable to make decisions for yourself.

Who can be my agent in Connecticut?

Your agent can be any competent adult who is willing to act on your behalf. It can be a family member, a friend, or even a professional such as an attorney or accountant.

What powers can I grant to my agent in Connecticut?

In Connecticut, you can grant your agent a wide range of powers, including the power to manage your finances, buy or sell property, make healthcare decisions, and handle legal matters. You can specify the exact powers you want to grant in the power of attorney document.

What is a power of attorney?

A power of attorney is a legal document that allows someone to make decisions and act on behalf of another person, known as the principal, in financial and legal matters.