- Understanding the Difference Between Quitclaim Deeds and Warranty Deeds

- What is a Quitclaim Deed?

- What is a Warranty Deed?

- Reasons to Convert a Quitclaim Deed to a Warranty Deed

- Ensuring Clear Ownership

- Question-answer:

- What is a quitclaim deed?

- Why would someone want to convert a quitclaim deed to a warranty deed?

- Do I need an attorney to convert a quitclaim deed to a warranty deed?

- What are the potential risks of converting a quitclaim deed to a warranty deed?

- What is a quitclaim deed?

- Why would someone want to convert a quitclaim deed to a warranty deed?

When it comes to real estate transactions, the type of deed used can have a significant impact on the rights and protections afforded to the parties involved. Two common types of deeds are quitclaim deeds and warranty deeds. While a quitclaim deed transfers any interest the grantor may have in the property, a warranty deed provides a guarantee that the grantor has clear title to the property and will defend against any claims.

If you currently hold a quitclaim deed and want to upgrade to a warranty deed, this step-by-step guide will walk you through the process. Converting a quitclaim deed to a warranty deed can provide you with added security and peace of mind, especially if you plan to sell the property in the future or want to ensure that your ownership rights are protected.

Step 1: Research the Requirements

Before you begin the conversion process, it’s important to research the specific requirements and regulations in your jurisdiction. Each state may have different rules regarding the conversion of deeds, so it’s crucial to understand the legal framework in your area. You may need to consult with a real estate attorney or visit your local county clerk’s office to gather the necessary information.

Step 2: Prepare the Necessary Documents

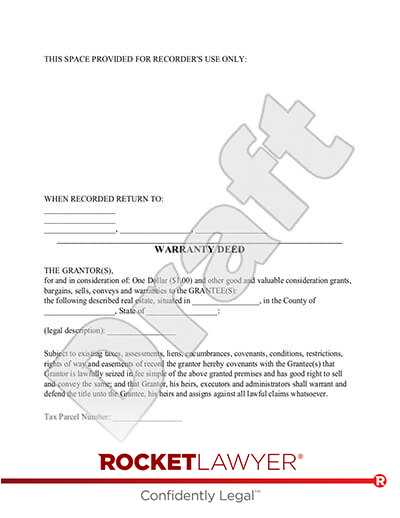

Once you have a clear understanding of the requirements, you’ll need to prepare the necessary documents for the conversion. This typically involves drafting a new warranty deed that includes all the relevant information, such as the names of the grantor and grantee, a legal description of the property, and any specific terms or conditions.

Step 3: Execute the Warranty Deed

After preparing the warranty deed, both the grantor and grantee must sign the document in the presence of a notary public. The notary public will then acknowledge the signatures and affix their official seal to the deed. This step is crucial to ensure the validity and enforceability of the warranty deed.

Step 4: Record the Warranty Deed

Once the warranty deed is executed, it’s important to record it with the appropriate government office. In most cases, this will be the county clerk’s office or the recorder of deeds. Recording the warranty deed serves as public notice of the change in ownership and helps establish a clear chain of title.

By following these steps, you can successfully convert a quitclaim deed to a warranty deed. Remember to consult with legal professionals and adhere to the specific requirements in your jurisdiction to ensure a smooth and legally valid conversion process.

Understanding the Difference Between Quitclaim Deeds and Warranty Deeds

When it comes to transferring property ownership, two common types of deeds are often used: quitclaim deeds and warranty deeds. While both serve the purpose of transferring property, there are significant differences between the two that you should be aware of.

A quitclaim deed, also known as a non-warranty deed, is a legal document that transfers the ownership interest of a property from one party to another. However, unlike a warranty deed, a quitclaim deed does not provide any guarantees or warranties regarding the property’s title. This means that the person transferring the property (the grantor) is not making any promises about the quality of the title or whether there are any liens or encumbrances on the property.

On the other hand, a warranty deed is a type of deed that provides certain guarantees and warranties to the buyer (grantee). With a warranty deed, the grantor is assuring the grantee that they have clear ownership of the property and that there are no undisclosed liens or encumbrances. In other words, the grantor is guaranteeing that they have the legal right to transfer the property and that the title is free from any defects.

One of the main differences between quitclaim deeds and warranty deeds is the level of protection they offer to the buyer. While a quitclaim deed provides no guarantees, a warranty deed offers a higher level of protection by ensuring that the grantee receives a clear and marketable title.

Another difference is the situations in which these deeds are commonly used. Quitclaim deeds are often used in situations where the transfer of property is between family members or parties who have a pre-existing relationship. They are also commonly used in situations where the grantor is unsure about the quality of the title or wants to transfer their interest without making any warranties.

On the other hand, warranty deeds are typically used in real estate transactions where the buyer wants the assurance that they are receiving a property with a clear title. This is especially important when purchasing property from someone you do not know or when obtaining financing from a lender.

In summary, quitclaim deeds and warranty deeds differ in the level of protection they offer and the situations in which they are commonly used. Understanding these differences can help you make an informed decision when it comes to transferring property ownership.

What is a Quitclaim Deed?

A quitclaim deed is a legal document used to transfer ownership of real property from one party to another. Unlike a warranty deed, a quitclaim deed does not provide any guarantees or warranties about the property’s title. Instead, it simply transfers whatever interest the grantor has in the property to the grantee.

This type of deed is often used in situations where the parties involved have an existing relationship and trust each other. It is commonly used to transfer property between family members, spouses, or business partners. However, it is important to note that a quitclaim deed does not provide any protection to the grantee if there are any issues with the property’s title.

When a quitclaim deed is executed, the grantor is essentially saying that they are giving up any claim they may have to the property. This means that if there are any liens, encumbrances, or other issues with the property’s title, the grantee will be responsible for dealing with them.

It is important to carefully consider the implications of using a quitclaim deed before deciding to transfer property in this way. If there are any concerns about the property’s title or potential issues with ownership, it may be advisable to use a warranty deed instead, which provides more protection to the grantee.

In summary, a quitclaim deed is a legal document used to transfer ownership of real property. It does not provide any guarantees or warranties about the property’s title and is often used in situations where the parties involved have an existing relationship and trust each other.

What is a Warranty Deed?

A warranty deed is a legal document that guarantees the seller (grantor) has the legal right to transfer ownership of a property to the buyer (grantee). It provides the highest level of protection for the buyer, as it includes several important warranties and promises.

When a property is transferred through a warranty deed, the grantor guarantees that:

- They are the legal owner of the property and have the right to sell it.

- The property is free from any liens or encumbrances, unless specifically stated in the deed.

- The grantor will defend the buyer against any claims made by third parties regarding the property.

- The grantor will compensate the buyer for any losses incurred due to a breach of these warranties.

Unlike a quitclaim deed, which only transfers the grantor’s interest in the property, a warranty deed provides the buyer with a guarantee of clear ownership. This means that if any issues arise after the sale, such as undisclosed liens or competing claims to the property, the buyer can seek legal recourse against the grantor.

Warranty deeds are commonly used in real estate transactions, especially when the buyer wants assurance that they are receiving a property with a clean title. They are often required by lenders when financing a property purchase, as it provides them with additional security.

It is important to note that warranty deeds do not provide protection against defects in the property itself, such as structural issues or zoning violations. These matters are typically addressed through other means, such as property inspections and title insurance.

In summary, a warranty deed is a legal document that guarantees the buyer clear ownership of a property and provides protection against any claims or encumbrances. It offers the highest level of protection for the buyer and is commonly used in real estate transactions.

Reasons to Convert a Quitclaim Deed to a Warranty Deed

Converting a quitclaim deed to a warranty deed can be a wise decision for several reasons:

- Clear Ownership: One of the main reasons to convert a quitclaim deed to a warranty deed is to ensure clear ownership of the property. A quitclaim deed only transfers the interest that the grantor has in the property, without making any guarantees about the title. On the other hand, a warranty deed provides a guarantee that the grantor has clear and marketable title to the property, giving the grantee more confidence in their ownership.

- Increased Marketability: By converting a quitclaim deed to a warranty deed, the property becomes more marketable. Potential buyers are often more willing to purchase a property with a warranty deed, as it provides them with greater assurance that they are receiving a property with a clear title. This can help attract more buyers and potentially increase the selling price of the property.

- Protection Against Future Claims: Another reason to convert a quitclaim deed to a warranty deed is to protect against future claims on the property. With a quitclaim deed, the grantee may be vulnerable to undisclosed liens, encumbrances, or other issues that could arise after the transfer of ownership. By obtaining a warranty deed, the grantee is provided with legal protection against such claims, minimizing the risk of future disputes.

- Financing Opportunities: Converting a quitclaim deed to a warranty deed can also open up financing opportunities. Lenders often prefer to work with properties that have a warranty deed, as it provides them with greater security in the event of default. Having a warranty deed may make it easier for the grantee to obtain a mortgage or other financing options for the property.

- Peace of Mind: Lastly, converting a quitclaim deed to a warranty deed can provide the grantee with peace of mind. Knowing that the property has been transferred with a warranty deed, which guarantees clear ownership and protects against future claims, can alleviate any concerns or uncertainties about the property’s title. This can lead to a greater sense of security and satisfaction for the grantee.

Overall, converting a quitclaim deed to a warranty deed offers numerous benefits, including clear ownership, increased marketability, protection against future claims, financing opportunities, and peace of mind. It is a proactive step that can provide both the grantor and the grantee with greater confidence and security in their property ownership.

Ensuring Clear Ownership

When converting a quitclaim deed to a warranty deed, one of the main reasons is to ensure clear ownership of the property. A quitclaim deed only transfers the interest that the grantor has in the property, without making any guarantees about the title. This means that there may be potential issues or claims on the property that the grantee is unaware of.

By converting to a warranty deed, the grantor is providing a guarantee that they have clear ownership of the property and that there are no undisclosed claims or issues. This can provide peace of mind to the grantee, as they can be confident that they are receiving a property with a clean title.

Ensuring clear ownership is important for various reasons. It can help prevent future legal disputes or challenges to the ownership of the property. It also allows the grantee to have full control and use of the property without any potential interference from other parties.

Converting to a warranty deed typically involves hiring a real estate attorney or title company to handle the process. They will conduct a thorough title search to ensure that there are no outstanding liens, encumbrances, or other issues that could affect the ownership of the property. If any issues are discovered, they can be addressed and resolved before the warranty deed is issued.

It is important for both the grantor and the grantee to understand the implications of converting to a warranty deed. The grantor is taking on additional liability by providing a guarantee of clear ownership, while the grantee is receiving the assurance of a clean title. It is recommended to consult with legal professionals to fully understand the legal and financial implications of converting a quitclaim deed to a warranty deed.

Question-answer:

What is a quitclaim deed?

A quitclaim deed is a legal document used to transfer ownership of real property from one party to another. Unlike a warranty deed, a quitclaim deed does not provide any guarantees or warranties about the property’s title.

Why would someone want to convert a quitclaim deed to a warranty deed?

There are several reasons why someone might want to convert a quitclaim deed to a warranty deed. One reason is to provide the new owner with a guarantee of clear title to the property. Another reason is to satisfy the requirements of a lender or a title insurance company, which may require a warranty deed for financing or insurance purposes.

Do I need an attorney to convert a quitclaim deed to a warranty deed?

While it is not always necessary to hire an attorney to convert a quitclaim deed to a warranty deed, it is recommended to seek legal advice, especially if you are unfamiliar with the process or if there are complex legal issues involved. An attorney can ensure that the conversion is done correctly and in compliance with local laws and regulations.

What are the potential risks of converting a quitclaim deed to a warranty deed?

Converting a quitclaim deed to a warranty deed may involve certain risks, such as potential disputes over the property’s title or undisclosed liens or encumbrances. It is important to thoroughly research the property’s history and consult with legal professionals to minimize these risks. Additionally, the conversion process may incur fees for recording and legal services.

What is a quitclaim deed?

A quitclaim deed is a legal document used to transfer ownership of a property from one party to another. Unlike a warranty deed, a quitclaim deed does not provide any guarantees or warranties about the property’s title.

Why would someone want to convert a quitclaim deed to a warranty deed?

There are several reasons why someone might want to convert a quitclaim deed to a warranty deed. One reason is that a warranty deed provides more protection to the buyer, as it guarantees that the seller has clear title to the property and will defend against any claims made by third parties. Additionally, some lenders may require a warranty deed in order to approve a mortgage or loan.