- Understanding Liens on Your Home

- What is a Lien?

- Types of Liens

- How Liens Affect Refinancing

- Steps to Refinance Your Home with a Lien

- Assessing the Lien

- Clearing the Lien

- Question-answer:

- What is refinancing?

- Can I refinance my home if there is a lien on it?

- What happens to the lien when I refinance my home?

- Can I refinance my home if the lien amount is higher than the value of my property?

- What are the potential risks of refinancing a home with a lien?

- What is refinancing?

- Can I refinance my home if there is a lien on it?

Refinancing your home can be a great way to lower your monthly mortgage payments or access the equity you’ve built up over time. However, if you have a lien on your property, the refinancing process can become more complicated. It’s important to understand how a lien can affect your ability to refinance and what steps you can take to navigate this situation.

A lien is a legal claim that a creditor has on your property as collateral for a debt. It can be placed on your home by a variety of entities, such as a contractor who hasn’t been paid for work done on your property, the IRS for unpaid taxes, or a lender who has a mortgage or home equity loan on your property. When you refinance your home, the new lender will want to ensure that they have the first lien position, meaning they have priority over any other creditors.

If you have a lien on your property, you’ll need to address it before you can refinance. This typically involves paying off the debt or negotiating a settlement with the creditor. Once the lien is satisfied, you can provide documentation to the new lender, showing that the lien has been released. This will allow the refinancing process to move forward.

It’s important to note that refinancing with a lien can be more challenging than a standard refinance. Lenders may view the presence of a lien as a higher risk, and you may need to meet additional requirements or pay a higher interest rate. It’s a good idea to shop around and compare offers from different lenders to ensure you’re getting the best terms possible.

Understanding Liens on Your Home

When it comes to owning a home, it’s important to understand the concept of liens. A lien is a legal claim or hold on a property that is used as collateral for a debt. It gives the creditor the right to take possession of the property if the debt is not repaid.

Liens can be placed on a property for various reasons, such as unpaid taxes, unpaid contractors or suppliers, or unpaid homeowners association fees. These liens can affect your ability to refinance your home, as lenders typically require a clear title before approving a refinance.

There are different types of liens that can be placed on a property. One common type is a tax lien, which is placed by the government for unpaid taxes. Another type is a mechanic’s lien, which is placed by contractors or suppliers who have not been paid for work or materials provided for the property.

Liens can have a significant impact on the refinancing process. When you apply for a refinance, the lender will conduct a title search to determine if there are any outstanding liens on the property. If there is a lien, the lender will require it to be paid off or cleared before approving the refinance.

If you have a lien on your home and want to refinance, there are steps you can take to address the lien. First, you will need to assess the lien and determine the amount owed. This can be done by contacting the creditor or conducting a title search.

Once you have assessed the lien, you will need to clear it before proceeding with the refinance. This can involve paying off the debt in full, negotiating a settlement with the creditor, or disputing the validity of the lien. Clearing the lien will require documentation and proof of payment or resolution.

Understanding liens on your home is crucial when considering refinancing. It’s important to be aware of any outstanding liens and take the necessary steps to address them before applying for a refinance. By doing so, you can ensure a smooth refinancing process and avoid any delays or complications.

What is a Lien?

A lien is a legal claim or right that a creditor has over a property as security for a debt or obligation. It gives the creditor the right to take possession of the property if the debt is not repaid. Liens are typically filed with the county or state where the property is located, and they can affect the ability to sell or refinance the property.

When a lien is placed on a property, it becomes encumbered, meaning that the property cannot be sold or transferred without satisfying the debt or obligation. Liens can be placed on a property for various reasons, such as unpaid taxes, unpaid contractor bills, or unpaid child support.

There are different types of liens, including voluntary liens and involuntary liens. Voluntary liens are created by the property owner, such as a mortgage or home equity loan. Involuntary liens are imposed by law, such as tax liens or mechanic’s liens.

Liens can have a significant impact on the refinancing process. When refinancing a home with a lien, the lien must be addressed and resolved before the new loan can be approved. This is because the lien holder has a legal claim on the property, and the new lender wants to ensure that their loan will be the first priority lien.

Overall, understanding liens and their implications is crucial when considering refinancing your home. It is important to assess any existing liens on your property and take the necessary steps to clear them before proceeding with the refinancing process.

Types of Liens

When it comes to liens on your home, there are several different types that you should be aware of. Each type of lien has its own specific characteristics and implications. Here are some common types of liens:

- Mortgage Lien: This is the most common type of lien and is created when you take out a mortgage loan to purchase your home. The mortgage lender has a lien on your property until the loan is paid off.

- Property Tax Lien: If you fail to pay your property taxes, the government can place a lien on your home. This type of lien takes priority over other liens and must be paid off before you can sell or refinance your home.

- Homeowners Association (HOA) Lien: If you are a member of a homeowners association and fail to pay your dues or assessments, the HOA can place a lien on your property. This type of lien can also take priority over other liens.

- Mechanic’s Lien: If you hire a contractor or subcontractor to work on your home and fail to pay them, they can file a mechanic’s lien. This type of lien gives the contractor a claim on your property until they are paid.

- Judgment Lien: If you are involved in a lawsuit and the court awards a judgment against you, the creditor can place a lien on your property to secure the debt. This type of lien can be enforced through a forced sale of your home.

These are just a few examples of the types of liens that can be placed on your home. It’s important to understand the specific implications of each type of lien and how they can affect your ability to refinance your home.

How Liens Affect Refinancing

When refinancing your home, it is important to understand how liens can affect the process. A lien is a legal claim that a creditor has on your property as collateral for a debt. Liens can be placed on your home for various reasons, such as unpaid taxes, unpaid contractors, or outstanding judgments.

Liens can complicate the refinancing process because they give the lienholder a legal right to the property. When you refinance your home, the new lender will require a clear title, meaning there should be no outstanding liens on the property. If there is a lien, it must be addressed and resolved before the refinancing can proceed.

Having a lien on your home can also affect the terms of your refinancing. Lenders may view a lien as a risk factor, as it indicates potential financial instability. This can result in higher interest rates or stricter loan terms. Additionally, some lenders may refuse to refinance a property with an outstanding lien.

Before refinancing your home with a lien, it is important to assess the lien and understand its implications. Determine the type of lien and the amount owed. This will help you determine the steps needed to clear the lien and proceed with the refinancing process.

Clearing a lien can be a complex process, depending on the type and amount owed. It may involve negotiating with the lienholder, paying off the debt in full, or setting up a payment plan. It is crucial to work with a qualified attorney or financial advisor to navigate the lien resolution process.

Once the lien is cleared, you can proceed with the refinancing process. Keep in mind that the lien may have affected your credit score, so it is important to review and improve your credit before applying for a refinance. This can help you secure better loan terms and potentially lower interest rates.

Steps to Refinance Your Home with a Lien

Refinancing your home with a lien can be a complex process, but it is possible to navigate with the right steps. Here are the key steps to follow:

1. Assessing the Lien: The first step is to assess the lien on your home. Determine the type of lien and the amount owed. This information will help you understand the impact it may have on your refinancing options.

2. Clearing the Lien: Before you can proceed with refinancing, you will need to clear the lien on your home. This typically involves paying off the debt or negotiating a settlement with the lienholder. It’s important to resolve the lien before moving forward with the refinancing process.

3. Gather Documentation: Collect all the necessary documentation for the refinancing application. This may include proof of income, tax returns, bank statements, and any other relevant financial documents. Having these documents ready will streamline the application process.

4. Shop for Lenders: Research and compare different lenders to find the best refinancing options for your situation. Consider factors such as interest rates, fees, and customer reviews. It’s important to choose a reputable lender who is experienced in dealing with liens on homes.

5. Apply for Refinancing: Once you have chosen a lender, submit your refinancing application. Provide all the required information and documentation accurately and promptly. Be prepared to answer any additional questions or provide further documentation if requested.

6. Wait for Approval: After submitting your application, you will need to wait for the lender to review and approve it. This process may take some time, so be patient. Stay in touch with your lender and respond promptly to any requests for additional information.

7. Close the Loan: If your refinancing application is approved, you will need to close the loan. This involves signing the necessary paperwork and paying any closing costs. Review the terms and conditions of the new loan carefully before signing.

8. Pay off the Lien: Once the refinancing is complete, use the funds from the new loan to pay off the lien on your home. Ensure that the lien is fully satisfied and obtain any necessary documentation to prove it.

By following these steps, you can successfully refinance your home even with a lien. It’s important to be proactive, thorough, and patient throughout the process to ensure a smooth refinancing experience.

Assessing the Lien

Before refinancing your home with a lien, it is crucial to assess the lien and understand its implications. Assessing the lien involves gathering information about the lienholder, the amount owed, and the terms of the lien.

The first step in assessing the lien is to identify the lienholder. This can usually be done by reviewing the documentation related to the lien, such as a mortgage or a judgment. The lienholder is the individual or entity that has a legal claim on your property due to an unpaid debt or obligation.

Once you have identified the lienholder, you need to determine the amount owed. This can be found in the documentation related to the lien or by contacting the lienholder directly. It is important to know the exact amount owed to understand the impact it will have on your refinancing options.

Next, you should review the terms of the lien. This includes understanding the interest rate, repayment terms, and any other conditions or restrictions associated with the lien. Some liens may have specific requirements that need to be met before they can be cleared or satisfied.

Assessing the lien also involves evaluating its priority. Liens can have different priorities based on the date they were filed or the type of lien. Understanding the lien’s priority is important because it determines the order in which liens are paid off in the event of a foreclosure or sale of the property.

Finally, it is essential to assess the impact of the lien on your refinancing options. Some lenders may be hesitant to approve a refinance if there is a lien on the property, while others may require the lien to be cleared before proceeding with the refinancing process. Assessing the lien will help you determine the best course of action to take when refinancing your home.

Clearing the Lien

Clearing a lien on your home is an essential step in refinancing. Before proceeding with the refinancing process, you must ensure that the lien is resolved and removed from your property title. Here are the steps to clear the lien:

1. Identify the lienholder:

The first step is to identify the lienholder. Contact the relevant authorities or consult your mortgage lender to determine who holds the lien on your property. This information is crucial as it will help you understand the requirements for clearing the lien.

2. Pay off the lien:

Once you have identified the lienholder, you need to pay off the outstanding debt. This can be done by negotiating a settlement or paying the full amount owed. Make sure to obtain a lien release document from the lienholder once the payment is made.

3. Obtain a lien release:

After paying off the lien, you must obtain a lien release document from the lienholder. This document serves as proof that the lien has been cleared and should be recorded with the appropriate authorities. Keep a copy of the lien release for your records.

4. Update property title:

Once you have the lien release document, you need to update your property title to reflect the cleared lien. This typically involves filing the lien release with the county recorder’s office or the relevant authority responsible for maintaining property records. This step is crucial to ensure that the lien no longer appears on your property title.

5. Provide documentation to the lender:

Finally, provide the lender with all the necessary documentation to prove that the lien has been cleared. This may include the lien release document, updated property title, and any other supporting documents required by the lender. The lender will review the documentation to ensure that the lien has been properly cleared before proceeding with the refinancing process.

Clearing a lien on your home can be a complex process, but it is necessary to proceed with refinancing. It is important to follow these steps carefully and consult with professionals if needed to ensure that the lien is properly cleared and does not hinder your refinancing plans.

Question-answer:

What is refinancing?

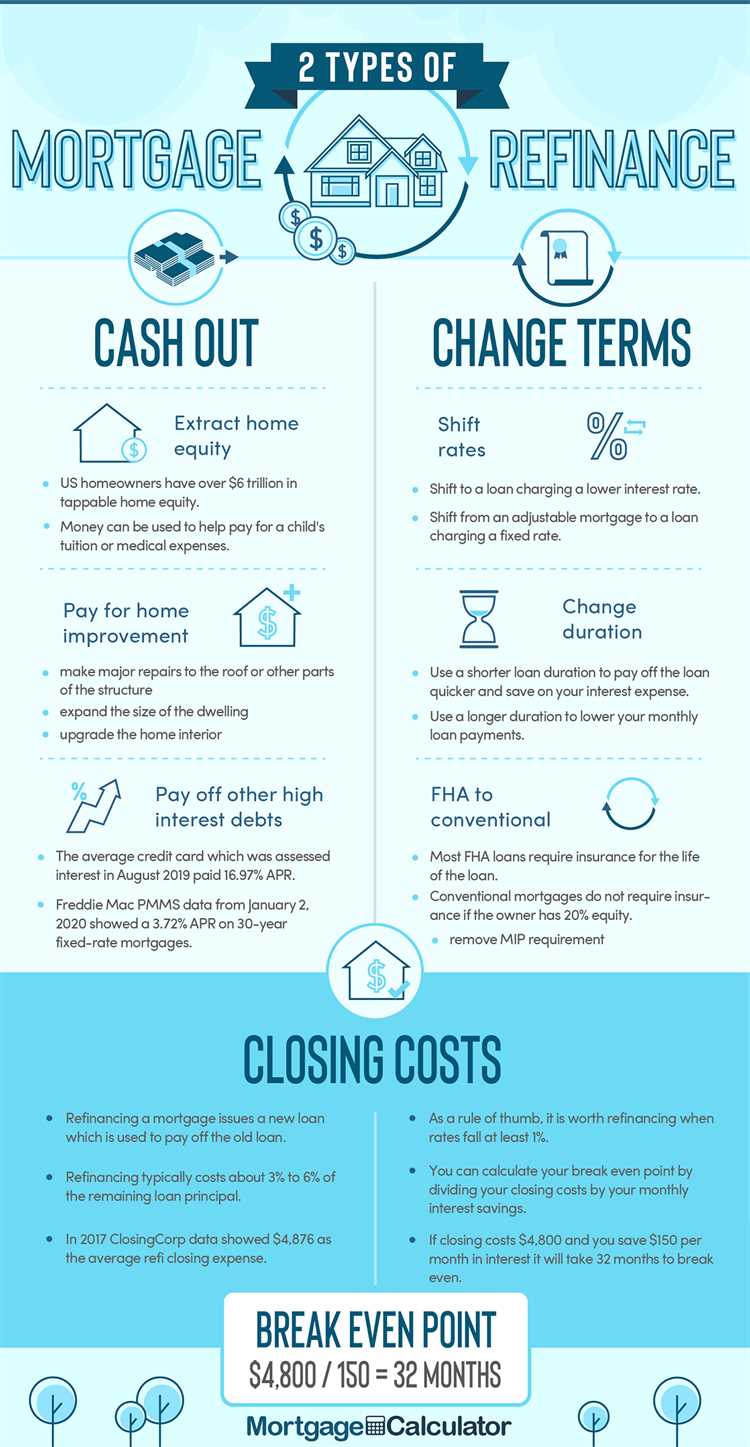

Refinancing is the process of replacing an existing mortgage with a new one, typically to obtain better loan terms or to access the equity in your home.

Can I refinance my home if there is a lien on it?

Yes, you can refinance your home even if there is a lien on it. However, the lien will need to be paid off or addressed during the refinancing process.

What happens to the lien when I refinance my home?

When you refinance your home, the new mortgage lender will typically pay off the existing lien. This means that the lien will be satisfied and no longer encumber your property.

Can I refinance my home if the lien amount is higher than the value of my property?

It may be difficult to refinance your home if the lien amount is higher than the value of your property. Lenders typically require that the loan-to-value ratio is within a certain range, and having a lien that exceeds the property value may make it challenging to meet those requirements.

What are the potential risks of refinancing a home with a lien?

Refinancing a home with a lien can have some risks. If the lien is not properly addressed during the refinancing process, it could result in complications or legal issues down the line. It’s important to work with a knowledgeable lender and ensure that all liens are properly addressed and paid off during the refinancing process.

What is refinancing?

Refinancing is the process of replacing an existing mortgage with a new one, usually to obtain better terms or lower interest rates.

Can I refinance my home if there is a lien on it?

Yes, it is possible to refinance your home even if there is a lien on it. However, the lien will need to be paid off or addressed during the refinancing process.