- Understanding the Relationship Between Home Ownership and Medical Insurance

- The Importance of Medical Insurance

- The Benefits of Home Ownership

- Exploring the Connection

- Options for Medical Insurance When You Own a Home

- Question-answer:

- Can I get medical insurance if I own a home?

- Does owning a home affect the cost of medical insurance?

- Do I need to provide proof of homeownership to get medical insurance?

- Can I use my home as collateral for medical insurance?

Medical insurance is an essential aspect of everyone’s life, providing financial protection against unexpected medical expenses. However, many people wonder if owning a home affects their eligibility for medical insurance. The answer to this question is no, owning a home does not directly impact your ability to obtain medical insurance.

Medical insurance is primarily based on factors such as your age, income, and health condition. Whether you rent or own a home is not a determining factor in the insurance application process. Insurance providers evaluate your eligibility based on your individual circumstances, not your housing status.

While owning a home may not directly affect your ability to get medical insurance, it is important to note that homeownership can indirectly impact your overall financial situation. Owning a home comes with additional expenses, such as mortgage payments, property taxes, and maintenance costs. These financial obligations may influence your ability to afford medical insurance premiums or affect your overall budget for healthcare expenses.

It is crucial to consider your financial situation holistically when determining your ability to obtain medical insurance. Owning a home should not be a barrier to accessing healthcare coverage, but it is essential to assess your overall financial stability and budget accordingly to ensure you can meet both your homeownership and healthcare needs.

Understanding the Relationship Between Home Ownership and Medical Insurance

Home ownership and medical insurance are two important aspects of a person’s life. While they may seem unrelated, there is actually a connection between the two. Understanding this relationship can help individuals make informed decisions about their healthcare and financial well-being.

One of the main ways in which home ownership and medical insurance are connected is through financial stability. Owning a home often signifies a certain level of financial security and stability. This stability can make it easier for individuals to afford and maintain medical insurance coverage.

When individuals own a home, they have a valuable asset that can be used to secure loans or lines of credit. This can be particularly helpful when it comes to paying for medical expenses. Homeowners may be able to use the equity in their homes to obtain a loan or line of credit to cover medical bills or health insurance premiums.

In addition, home ownership can also impact an individual’s eligibility for certain types of medical insurance. Some insurance providers may offer discounts or special rates to homeowners, as they are seen as more responsible and stable individuals. This can make medical insurance more affordable and accessible for those who own a home.

Furthermore, owning a home can provide individuals with a sense of stability and peace of mind. This can have a positive impact on their overall health and well-being. Studies have shown that individuals who own a home are more likely to have better physical and mental health outcomes compared to those who rent.

On the other hand, having medical insurance is crucial for individuals to access necessary healthcare services. Medical insurance provides financial protection against unexpected medical expenses and ensures that individuals can receive the care they need without incurring significant financial burdens.

Overall, the relationship between home ownership and medical insurance is multifaceted. Home ownership can provide individuals with financial stability, which can make it easier to afford and maintain medical insurance coverage. Additionally, owning a home can impact an individual’s eligibility for certain types of medical insurance. Understanding this relationship can help individuals make informed decisions about their healthcare and financial well-being.

The Importance of Medical Insurance

Medical insurance is an essential aspect of financial planning and personal well-being. It provides individuals and families with the necessary coverage to access quality healthcare services without incurring significant out-of-pocket expenses. Here are some reasons why medical insurance is important:

- Financial Protection: Medical treatments and procedures can be expensive, and without insurance, individuals may face substantial financial burdens. Medical insurance helps protect against these high costs by covering a portion or all of the medical expenses, depending on the policy.

- Access to Healthcare: Having medical insurance ensures that individuals have access to a wide range of healthcare services. It allows them to visit doctors, specialists, and hospitals without worrying about the cost. This access to healthcare promotes early detection and prevention of diseases, leading to better overall health outcomes.

- Peace of Mind: Knowing that you have medical insurance provides peace of mind. It eliminates the stress and anxiety associated with unexpected medical emergencies or illnesses. With insurance, individuals can focus on their recovery and well-being, rather than worrying about the financial implications.

- Preventive Care: Medical insurance often covers preventive care services, such as vaccinations, screenings, and annual check-ups. These preventive measures help identify potential health issues early on, allowing for timely intervention and treatment. By investing in preventive care, individuals can maintain good health and prevent more serious conditions from developing.

- Protection for Your Family: Medical insurance not only provides coverage for individuals but also extends to their family members. This means that spouses, children, and dependents can also benefit from the same level of healthcare protection. This ensures that everyone in the family can receive the necessary medical care when needed.

The Benefits of Home Ownership

Home ownership comes with a multitude of benefits that can positively impact various aspects of your life. Here are some key advantages of owning a home:

| 1. Financial Stability: | Owning a home provides a sense of financial stability as it is a long-term investment. Unlike renting, where monthly payments can increase over time, homeownership allows you to have a fixed mortgage payment, providing predictability and control over your housing expenses. |

| 2. Building Equity: | When you own a home, you have the opportunity to build equity. Equity is the difference between the market value of your property and the amount you owe on your mortgage. As you make mortgage payments and the value of your home appreciates, your equity increases. This equity can be used for future financial endeavors, such as funding education, starting a business, or retirement. |

| 3. Tax Benefits: | Homeownership offers various tax benefits. Mortgage interest and property tax payments are generally tax-deductible, reducing your overall tax liability. Additionally, if you sell your primary residence and meet certain criteria, you may be eligible for capital gains tax exclusions. |

| 4. Sense of Community: | Owning a home often fosters a stronger sense of community. When you own a home, you are more likely to establish roots in a neighborhood, get involved in local activities, and build relationships with your neighbors. This sense of community can enhance your overall well-being and quality of life. |

| 5. Creative Freedom: | As a homeowner, you have the freedom to personalize and modify your living space according to your preferences. You can make renovations, paint walls, and create a home that reflects your unique style and personality. This creative freedom allows you to truly make your house a home. |

Exploring the Connection

When it comes to the relationship between home ownership and medical insurance, there are several factors to consider. Owning a home can have a positive impact on your ability to obtain medical insurance and can provide additional benefits that can contribute to your overall health and well-being.

One of the main ways that home ownership can affect your medical insurance is through the stability it provides. Insurance companies often consider stability as a factor when determining eligibility and rates. Owning a home demonstrates financial stability and responsibility, which can make you a more attractive candidate for medical insurance coverage.

In addition to stability, home ownership can also provide financial benefits that can help you afford medical insurance. For example, if you have a mortgage, you may be able to deduct the interest you pay on your loan from your taxes. This can result in significant savings that can be used towards medical insurance premiums.

Furthermore, owning a home can provide a sense of security and peace of mind, which can positively impact your overall health. Studies have shown that individuals who own their homes tend to have lower stress levels and better mental health. This can lead to a decreased need for medical care and lower medical insurance costs.

Additionally, owning a home can provide opportunities for preventive care. For example, if you have a backyard, you may be more likely to engage in physical activities such as gardening or exercising outdoors. This can contribute to better physical health and reduce the need for medical interventions.

Overall, the connection between home ownership and medical insurance is multifaceted. Owning a home can provide stability, financial benefits, and a sense of security, all of which can positively impact your ability to obtain and afford medical insurance. Additionally, home ownership can contribute to better overall health and well-being, leading to lower medical insurance costs in the long run.

Options for Medical Insurance When You Own a Home

When you own a home, you have several options for obtaining medical insurance. It is important to explore these options to ensure that you and your family have the coverage you need.

1. Employer-Sponsored Health Insurance: Many homeowners have access to health insurance through their employer. This type of insurance is typically offered as part of an employee benefits package and can provide comprehensive coverage for you and your dependents.

2. Private Health Insurance: If you do not have access to employer-sponsored health insurance, you can purchase a private health insurance plan. These plans are available through insurance companies and offer a range of coverage options to fit your needs and budget.

3. Health Savings Accounts (HSAs): Another option for homeowners is to open a health savings account (HSA). HSAs allow you to set aside pre-tax dollars to be used for qualified medical expenses. This can be a cost-effective way to pay for medical care while also saving for the future.

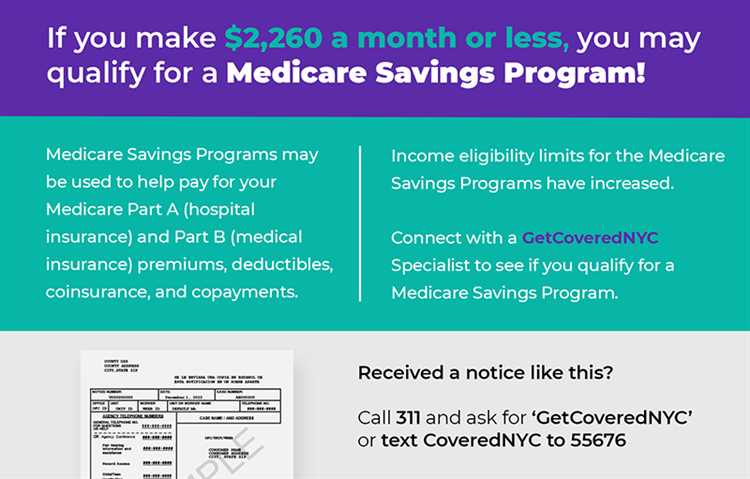

4. Medicaid: Depending on your income and other factors, you may qualify for Medicaid, a government program that provides health insurance to low-income individuals and families. Medicaid coverage varies by state, so it is important to check your eligibility and the specific benefits available in your area.

5. Medicare: If you are 65 years or older, you may be eligible for Medicare, a federal health insurance program for seniors. Medicare provides coverage for hospital stays, doctor visits, prescription drugs, and other medical services.

6. Health Insurance Marketplace: The Health Insurance Marketplace, also known as the Affordable Care Act (ACA) marketplace, is an online platform where individuals and families can compare and purchase health insurance plans. Depending on your income, you may qualify for subsidies to help lower the cost of your premiums.

It is important to carefully consider your options and choose a medical insurance plan that meets your needs and budget. Owning a home does not automatically guarantee medical insurance, but it does provide you with more options and flexibility in finding coverage.

Question-answer:

Can I get medical insurance if I own a home?

Yes, you can still get medical insurance even if you own a home. Owning a home does not affect your eligibility for medical insurance.

Does owning a home affect the cost of medical insurance?

No, owning a home does not directly affect the cost of medical insurance. The cost of medical insurance is determined by various factors such as your age, location, and the type of coverage you choose.

Do I need to provide proof of homeownership to get medical insurance?

No, you do not need to provide proof of homeownership to get medical insurance. The process of getting medical insurance typically involves providing personal information, such as your age, income, and medical history, but homeownership is not a requirement.

Can I use my home as collateral for medical insurance?

No, you cannot use your home as collateral for medical insurance. Medical insurance is a separate type of insurance that covers the cost of medical expenses, while collateral is typically used for securing loans or other financial obligations.