- Understanding Bankruptcy for Business Owners

- Types of Bankruptcy for Business Owners

- The Impact of Bankruptcy on Business Owners

- Factors to Consider when Filing Bankruptcy as a Business Owner

- Business Structure and Personal Liability

- Assets and Debts

- The Role of Business Bankruptcy Attorneys

- Question-answer:

- Can I file for bankruptcy if I own a business?

- What are the different types of bankruptcy that I can consider if I own a business?

- What happens to my business if I file for bankruptcy?

- Can I keep my business if I file for bankruptcy?

Bankruptcy can be a difficult and overwhelming process, especially if you own a business. Many business owners wonder if they can file for bankruptcy and what the implications would be for their business. In this article, we will explore the options available to business owners who are considering bankruptcy.

First and foremost, it is important to understand that there are different types of bankruptcy, and the type you choose will depend on your specific situation. The most common types of bankruptcy for businesses are Chapter 7 and Chapter 11. Chapter 7 bankruptcy involves liquidating your assets to pay off your debts, while Chapter 11 bankruptcy allows you to reorganize your debts and continue operating your business.

If you choose to file for Chapter 7 bankruptcy, it is likely that your business will be dissolved. This means that your assets will be sold off to pay your creditors, and your business will cease to exist. However, if you file for Chapter 11 bankruptcy, you may be able to keep your business running while you work out a plan to repay your debts.

It is important to note that filing for bankruptcy can have serious consequences for your personal and professional life. Your credit score will be negatively affected, and it may be difficult to obtain credit in the future. Additionally, bankruptcy filings are a matter of public record, which means that anyone can access this information. This could potentially harm your reputation and make it difficult to secure future business opportunities.

Understanding Bankruptcy for Business Owners

Bankruptcy can be a complex and overwhelming process, especially for business owners. Understanding the basics of bankruptcy and how it applies to business owners is crucial for making informed decisions.

Bankruptcy for business owners involves the legal process of seeking relief from overwhelming debts and financial obligations. It provides an opportunity for businesses to reorganize their finances or liquidate their assets in order to repay creditors.

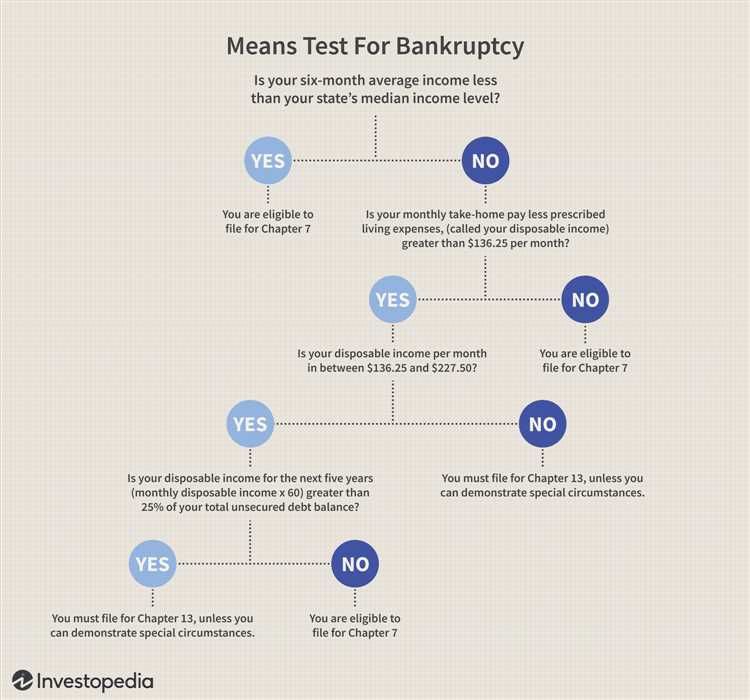

There are different types of bankruptcy that business owners can consider, depending on their specific circumstances. Chapter 7 bankruptcy involves liquidating assets to repay debts, while Chapter 11 bankruptcy allows businesses to reorganize and continue operations. Chapter 13 bankruptcy is available for sole proprietors and individuals with regular income.

When a business owner files for bankruptcy, it can have significant implications for both the business and the owner personally. It may result in the closure of the business, loss of assets, and damage to the owner’s credit. However, bankruptcy can also provide a fresh start and a chance to rebuild financially.

There are several factors that business owners should consider before filing for bankruptcy. One important factor is the business structure and personal liability. Sole proprietors and partnerships have unlimited personal liability, meaning their personal assets can be used to repay business debts. On the other hand, corporations and limited liability companies (LLCs) offer limited personal liability protection.

Another factor to consider is the business’s assets and debts. It is important to assess the value of the assets and determine if they are worth liquidating or if they can be used to reorganize the business. Additionally, understanding the extent of the business’s debts and obligations is crucial for determining the best course of action.

Seeking the guidance of a business bankruptcy attorney is highly recommended for business owners considering bankruptcy. An attorney can provide expert advice, help navigate the legal process, and ensure that the business owner’s rights and interests are protected. They can also assist in developing a comprehensive bankruptcy plan that aligns with the business’s goals and objectives.

Types of Bankruptcy for Business Owners

When it comes to bankruptcy for business owners, there are several types to consider. Each type has its own set of rules and requirements, so it’s important to understand the differences before making a decision. Here are the main types of bankruptcy for business owners:

- Chapter 7 Bankruptcy: This type of bankruptcy is also known as liquidation bankruptcy. It involves the sale of the business’s assets to repay creditors. Once the assets are sold, the business is typically dissolved.

- Chapter 11 Bankruptcy: Chapter 11 bankruptcy is often referred to as reorganization bankruptcy. It allows the business to continue operating while developing a plan to repay creditors. This type of bankruptcy is commonly used by large corporations.

- Chapter 13 Bankruptcy: While Chapter 13 bankruptcy is typically used by individuals, it can also be an option for small business owners who have a steady income. This type of bankruptcy involves creating a repayment plan to pay off debts over a period of three to five years.

- Chapter 12 Bankruptcy: Chapter 12 bankruptcy is specifically designed for family farmers and fishermen. It allows them to restructure their debts and continue operating their business.

Each type of bankruptcy has its own advantages and disadvantages, so it’s important to consult with a bankruptcy attorney to determine which option is best for your specific situation. They can help you navigate the complex legal process and ensure that you understand your rights and obligations.

The Impact of Bankruptcy on Business Owners

Bankruptcy can have a significant impact on business owners, both personally and professionally. It is important for business owners to understand the potential consequences before deciding to file for bankruptcy.

One of the main impacts of bankruptcy on business owners is the potential loss of their business. Depending on the type of bankruptcy filed, the business may be liquidated to repay creditors or restructured to continue operations. In either case, the business owner may no longer have control over their company.

Bankruptcy can also have a negative impact on a business owner’s personal finances. Depending on the business structure, the owner may be personally liable for the business’s debts. This means that personal assets, such as homes or vehicles, may be at risk of being seized to repay creditors.

Additionally, bankruptcy can damage a business owner’s credit score. This can make it difficult to secure loans or credit in the future, both for personal and business purposes. It may also impact the owner’s ability to attract investors or partners for future business ventures.

Furthermore, bankruptcy can have emotional and psychological impacts on business owners. The stress and uncertainty of the bankruptcy process can take a toll on their mental well-being. It can also strain relationships with employees, customers, and suppliers, leading to further challenges in rebuilding the business.

Overall, the impact of bankruptcy on business owners is significant and should not be taken lightly. It is crucial for business owners to carefully consider their options and seek professional advice before making any decisions regarding bankruptcy.

Factors to Consider when Filing Bankruptcy as a Business Owner

When considering filing for bankruptcy as a business owner, there are several important factors that need to be taken into account. Bankruptcy is a complex legal process that can have significant implications for both the business and the owner personally. Here are some key factors to consider:

- Financial Situation: Assessing the overall financial situation of the business is crucial. This includes evaluating the company’s assets, debts, and cash flow. Understanding the financial health of the business will help determine if bankruptcy is the best option.

- Business Structure: The type of business structure can impact the owner’s personal liability. For example, if the business is a sole proprietorship or a general partnership, the owner may be personally responsible for the business debts. On the other hand, if the business is a corporation or a limited liability company (LLC), the owner’s personal liability may be limited.

- Impact on Credit: Filing for bankruptcy can have a significant impact on the owner’s personal credit. It is important to consider how this may affect future borrowing and financial opportunities.

- Recovery Options: Before filing for bankruptcy, it is essential to explore other potential options for business recovery. This may include negotiating with creditors, restructuring debts, or seeking additional financing.

- Legal Consequences: Filing for bankruptcy involves a complex legal process. It is crucial to consult with a business bankruptcy attorney to understand the legal consequences and requirements.

- Personal Finances: The owner’s personal finances may also be affected by the business bankruptcy. It is important to consider how the bankruptcy may impact personal assets, such as homes, vehicles, and savings.

- Employee Considerations: Bankruptcy can have implications for employees, such as potential job losses or changes in employment terms. It is important to consider the impact on employees and comply with legal obligations.

- Long-Term Goals: Lastly, it is essential to consider the long-term goals for the business and the owner. Bankruptcy may provide a fresh start for the business, but it is important to assess whether it aligns with the owner’s long-term objectives.

Overall, filing for bankruptcy as a business owner is a significant decision that requires careful consideration of various factors. Consulting with a business bankruptcy attorney can provide valuable guidance and help navigate the complex process.

Business Structure and Personal Liability

When considering filing for bankruptcy as a business owner, it is important to understand the relationship between your business structure and personal liability. The structure of your business can have a significant impact on your personal liability for the business’s debts.

There are several common business structures, including sole proprietorships, partnerships, limited liability companies (LLCs), and corporations. Each structure has its own implications for personal liability in the event of bankruptcy.

1. Sole Proprietorship: If you operate your business as a sole proprietorship, there is no legal distinction between you and your business. This means that you are personally responsible for all of the business’s debts. If you file for bankruptcy as a sole proprietor, your personal assets may be at risk of being used to satisfy the business’s debts.

2. Partnership: In a partnership, each partner is personally liable for the business’s debts. If the partnership files for bankruptcy, the partners may be required to use their personal assets to satisfy the business’s obligations.

3. Limited Liability Company (LLC): An LLC provides limited liability protection to its owners, known as members. This means that the members are generally not personally liable for the business’s debts. However, if the LLC is unable to satisfy its obligations, the members may still be required to contribute additional funds to the business.

4. Corporation: A corporation is a separate legal entity from its owners, known as shareholders. As a result, shareholders are generally not personally liable for the corporation’s debts. If the corporation files for bankruptcy, the shareholders’ personal assets are typically protected.

It is important to note that personal liability can be increased if a business owner has personally guaranteed a loan or debt on behalf of the business. In such cases, the business owner may still be responsible for the debt even if the business files for bankruptcy.

When considering bankruptcy as a business owner, it is crucial to consult with a business bankruptcy attorney who can provide guidance based on your specific circumstances. They can help you understand the potential impact on your personal liability and develop a strategy to protect your assets to the greatest extent possible.

Assets and Debts

When filing for bankruptcy as a business owner, it is crucial to understand the impact it will have on your assets and debts. Bankruptcy involves the liquidation or reorganization of your business’s assets and the discharge or repayment of its debts.

Assets refer to any property or resources that your business owns. This can include physical assets such as real estate, equipment, inventory, and vehicles, as well as intangible assets like patents, trademarks, and intellectual property. When filing for bankruptcy, these assets may be sold or used to repay your debts.

Debts, on the other hand, are the financial obligations that your business owes to creditors. This can include loans, credit card debt, unpaid bills, and any other outstanding financial obligations. Bankruptcy allows for the discharge or restructuring of these debts, providing the business with a fresh start.

It is important to note that not all assets and debts are treated the same in bankruptcy. Some assets may be exempt from liquidation, meaning they are protected and cannot be used to repay debts. These exemptions vary depending on the bankruptcy laws of your jurisdiction.

Similarly, not all debts can be discharged in bankruptcy. Certain types of debts, such as taxes, student loans, and child support payments, are generally not dischargeable. However, bankruptcy can still provide relief by restructuring these debts and creating a manageable repayment plan.

When considering bankruptcy as a business owner, it is essential to take stock of your assets and debts. This will help you understand the potential impact of bankruptcy on your business and determine the best course of action. Consulting with a business bankruptcy attorney can provide valuable guidance and ensure that you navigate the bankruptcy process effectively.

The Role of Business Bankruptcy Attorneys

When it comes to filing for bankruptcy as a business owner, it is crucial to have the guidance and expertise of a business bankruptcy attorney. These professionals specialize in navigating the complex legal processes and can provide invaluable assistance throughout the bankruptcy proceedings.

One of the primary roles of a business bankruptcy attorney is to assess the financial situation of the business and determine the most appropriate type of bankruptcy to file. They will carefully evaluate the assets, debts, and liabilities of the business to determine whether Chapter 7, Chapter 11, or Chapter 13 bankruptcy is the best option.

Once the bankruptcy type is determined, the attorney will assist in preparing and filing the necessary paperwork. This includes gathering financial documents, creating a comprehensive list of creditors, and preparing the bankruptcy petition. The attorney will ensure that all the required information is accurately presented to the court.

During the bankruptcy proceedings, the business bankruptcy attorney will act as a representative for the business owner. They will attend court hearings, negotiate with creditors, and handle any legal disputes that may arise. Their expertise in bankruptcy law allows them to effectively advocate for the best interests of the business owner.

Additionally, a business bankruptcy attorney can provide guidance on how to protect the business and personal assets during the bankruptcy process. They can advise on strategies to minimize the impact of bankruptcy on the business owner’s personal finances and help develop a plan for rebuilding credit after bankruptcy.

Overall, the role of a business bankruptcy attorney is to provide expert legal counsel and support to business owners facing financial difficulties. They play a crucial role in navigating the complex bankruptcy process, protecting the rights and interests of the business owner, and helping them achieve a fresh start.

Question-answer:

Can I file for bankruptcy if I own a business?

Yes, you can file for bankruptcy even if you own a business. However, the process may be more complex and there are different types of bankruptcy that you can consider depending on your situation.

What are the different types of bankruptcy that I can consider if I own a business?

If you own a business, you can consider filing for either Chapter 7 bankruptcy or Chapter 11 bankruptcy. Chapter 7 bankruptcy is a liquidation bankruptcy where your business assets are sold to repay your debts, while Chapter 11 bankruptcy is a reorganization bankruptcy that allows you to continue operating your business while repaying your debts over time.

What happens to my business if I file for bankruptcy?

If you file for Chapter 7 bankruptcy, your business assets will be sold to repay your debts and your business will be closed. However, if you file for Chapter 11 bankruptcy, you can continue operating your business while repaying your debts under a court-approved reorganization plan.

Can I keep my business if I file for bankruptcy?

Whether you can keep your business if you file for bankruptcy depends on the type of bankruptcy you file. If you file for Chapter 7 bankruptcy, your business will be closed. However, if you file for Chapter 11 bankruptcy, you can continue operating your business while repaying your debts under a court-approved reorganization plan.