- Understanding Home Equity Loans

- What is a Home Equity Loan?

- How Does a Home Equity Loan Work?

- Benefits of a Home Equity Loan

- Can You Have a Cosigner on a Home Equity Loan?

- Question-answer:

- What is a cosigner?

- Can you have a cosigner on a home equity loan?

- Why would someone need a cosigner for a home equity loan?

- What are the risks of being a cosigner on a home equity loan?

- Can a cosigner be removed from a home equity loan?

- What is a cosigner?

When it comes to obtaining a home equity loan, many borrowers wonder if they can have a cosigner. A cosigner is someone who agrees to take on the responsibility of the loan if the primary borrower is unable to make payments. While it is possible to have a cosigner on a home equity loan, there are certain factors to consider.

First and foremost, it is important to understand that not all lenders allow cosigners on home equity loans. Each lender has their own policies and requirements, so it is crucial to do your research and find a lender that allows cosigners if you are considering this option.

Having a cosigner on a home equity loan can be beneficial for borrowers who may not meet the lender’s requirements on their own. For example, if a borrower has a low credit score or a high debt-to-income ratio, having a cosigner with a strong credit history and stable income can increase their chances of getting approved for the loan.

However, it is important to note that being a cosigner comes with its own risks. If the primary borrower defaults on the loan, the cosigner becomes responsible for repaying the debt. This can have a negative impact on the cosigner’s credit score and financial situation. Therefore, it is crucial for both the borrower and the cosigner to fully understand the terms and responsibilities of the loan before entering into an agreement.

Understanding Home Equity Loans

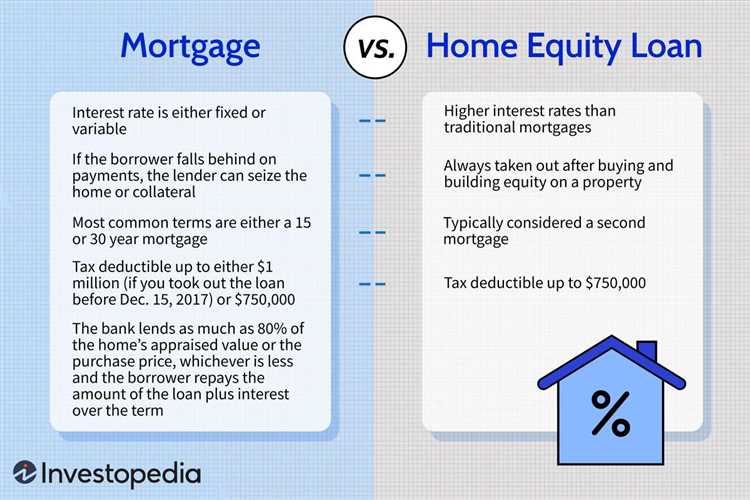

A home equity loan is a type of loan that allows homeowners to borrow money against the equity they have built up in their homes. Equity is the difference between the current market value of the home and the outstanding balance on the mortgage. Home equity loans are often used for major expenses such as home renovations, medical bills, or debt consolidation.

When you take out a home equity loan, you are essentially using your home as collateral. This means that if you fail to repay the loan, the lender has the right to foreclose on your home and sell it to recoup their losses. Because of this, it is important to carefully consider whether a home equity loan is the right choice for you.

Home equity loans typically have fixed interest rates and repayment terms, which can make them a more predictable and manageable option compared to other types of loans. The interest rates on home equity loans are often lower than those on credit cards or personal loans, making them an attractive option for borrowers looking to consolidate high-interest debt.

One of the key advantages of a home equity loan is that the interest you pay may be tax-deductible. However, it is important to consult with a tax professional to understand the specific tax implications in your situation.

It is also worth noting that home equity loans are different from home equity lines of credit (HELOCs). While both allow you to borrow against the equity in your home, a home equity loan provides a lump sum of money upfront, while a HELOC works more like a credit card, allowing you to borrow and repay funds as needed.

Before taking out a home equity loan, it is important to carefully consider your financial situation and goals. Make sure you understand the terms and conditions of the loan, including the interest rate, repayment period, and any fees or penalties that may apply. It may also be helpful to compare offers from multiple lenders to ensure you are getting the best possible terms.

What is a Home Equity Loan?

A home equity loan is a type of loan that allows homeowners to borrow money against the equity they have built up in their home. Equity is the difference between the current market value of the home and the outstanding balance on the mortgage. This type of loan is secured by the home itself, making it a secured loan.

Home equity loans are often used for major expenses such as home renovations, medical bills, or debt consolidation. The loan amount is determined by the value of the home and the amount of equity the homeowner has. The interest rates on home equity loans are typically lower than other types of loans because they are secured by the home.

When a homeowner takes out a home equity loan, they receive a lump sum of money that is repaid over a fixed period of time, usually with a fixed interest rate. The loan is repaid in monthly installments, similar to a mortgage. The homeowner’s equity in the home serves as collateral for the loan, meaning that if they fail to repay the loan, the lender can foreclose on the home.

It’s important to note that a home equity loan is different from a home equity line of credit (HELOC). While a home equity loan provides a lump sum of money, a HELOC works more like a credit card, allowing homeowners to borrow money as needed up to a certain limit.

Overall, a home equity loan can be a useful financial tool for homeowners who need to access the equity in their home for large expenses. However, it’s important to carefully consider the terms and conditions of the loan and ensure that the borrower can comfortably afford the monthly payments.

How Does a Home Equity Loan Work?

A home equity loan is a type of loan that allows homeowners to borrow money against the equity they have built up in their home. Equity is the difference between the current market value of the home and the amount still owed on the mortgage.

When a homeowner applies for a home equity loan, the lender will assess the value of the property and the amount of equity the homeowner has. Based on this assessment, the lender will determine the maximum amount that can be borrowed. The homeowner can then choose to borrow the full amount or a portion of it.

Once the loan is approved, the homeowner will receive the funds in a lump sum. The loan is typically repaid over a fixed term, with monthly payments that include both principal and interest. The interest rate on a home equity loan is usually fixed, meaning it will not change over the life of the loan.

One of the key features of a home equity loan is that the borrower’s home serves as collateral for the loan. This means that if the borrower fails to make the required payments, the lender has the right to foreclose on the property and sell it to recover the outstanding balance.

Home equity loans can be used for a variety of purposes, such as home improvements, debt consolidation, or funding education expenses. The interest paid on a home equity loan may be tax-deductible, depending on the borrower’s individual circumstances.

It is important for homeowners to carefully consider their financial situation and their ability to repay the loan before taking out a home equity loan. Defaulting on a home equity loan can have serious consequences, including the loss of the borrower’s home.

Benefits of a Home Equity Loan

A home equity loan can provide numerous benefits for homeowners. Here are some of the key advantages:

| 1. Lower Interest Rates: | One of the main benefits of a home equity loan is that it typically offers lower interest rates compared to other types of loans, such as personal loans or credit cards. This can result in significant savings over the life of the loan. |

| 2. Access to Large Amounts of Money: | With a home equity loan, homeowners can borrow a substantial amount of money based on the equity they have built up in their property. This can be particularly useful for major expenses, such as home renovations, medical bills, or debt consolidation. |

| 3. Fixed Interest Rates: | Unlike some other types of loans, home equity loans often come with fixed interest rates. This means that the interest rate will remain the same throughout the life of the loan, providing borrowers with stability and predictability in their monthly payments. |

| 4. Potential Tax Benefits: | In certain cases, the interest paid on a home equity loan may be tax-deductible. Homeowners should consult with a tax professional to determine if they qualify for any tax benefits associated with their home equity loan. |

| 5. Flexibility in Use: | Home equity loans offer borrowers flexibility in how they use the funds. Whether it’s for home improvements, education expenses, or any other financial need, homeowners have the freedom to allocate the loan proceeds as they see fit. |

| 6. Potential to Increase Home Value: | Investing in home improvements using a home equity loan can potentially increase the value of the property. This can be beneficial if homeowners plan to sell their home in the future, as it can result in a higher selling price and a greater return on investment. |

Overall, a home equity loan can be a valuable financial tool for homeowners, providing them with access to funds at a lower interest rate and offering flexibility in use. However, it’s important for borrowers to carefully consider their financial situation and consult with a professional before taking out a home equity loan.

Can You Have a Cosigner on a Home Equity Loan?

When it comes to obtaining a home equity loan, having a cosigner can be a helpful option for borrowers who may not meet the lender’s requirements on their own. A cosigner is someone who agrees to take on the responsibility of repaying the loan if the primary borrower is unable to do so.

While it is possible to have a cosigner on a home equity loan, not all lenders allow this arrangement. It is important to check with the lender beforehand to determine their specific requirements and policies regarding cosigners.

Having a cosigner can provide several benefits for borrowers. First, it can increase the chances of loan approval, especially if the primary borrower has a low credit score or insufficient income. The cosigner’s strong credit history and income can help offset any weaknesses in the primary borrower’s financial profile.

In addition, having a cosigner can also result in a lower interest rate on the home equity loan. Lenders may offer more favorable terms and rates when a cosigner is involved, as it reduces the risk for the lender.

However, it is important to note that being a cosigner comes with its own set of risks and responsibilities. The cosigner is equally responsible for repaying the loan, and any missed payments or defaults can negatively impact both the primary borrower’s and the cosigner’s credit scores.

Before agreeing to be a cosigner on a home equity loan, it is crucial for the cosigner to carefully consider their own financial situation and ability to take on the additional debt. They should also have a clear understanding of the terms and conditions of the loan, as well as their rights and obligations as a cosigner.

Question-answer:

What is a cosigner?

A cosigner is a person who agrees to take on the responsibility of repaying a loan if the primary borrower is unable to do so.

Can you have a cosigner on a home equity loan?

Yes, it is possible to have a cosigner on a home equity loan. The cosigner will be equally responsible for repaying the loan if the primary borrower defaults.

Why would someone need a cosigner for a home equity loan?

Someone may need a cosigner for a home equity loan if they have a low credit score or a high debt-to-income ratio. A cosigner with a strong credit history can help the borrower qualify for a loan or secure a lower interest rate.

What are the risks of being a cosigner on a home equity loan?

Being a cosigner on a home equity loan carries significant risks. If the primary borrower defaults on the loan, the cosigner will be responsible for repaying the entire loan amount. This can negatively impact the cosigner’s credit score and financial stability.

Can a cosigner be removed from a home equity loan?

In some cases, it may be possible to remove a cosigner from a home equity loan. This typically requires refinancing the loan in the primary borrower’s name only, and the borrower must meet certain eligibility criteria, such as having a strong credit history and sufficient income.

What is a cosigner?

A cosigner is a person who agrees to take on the responsibility of repaying a loan if the primary borrower is unable to do so. They essentially act as a guarantor for the loan.