- Understanding Power of Attorney

- What is Power of Attorney?

- Types of Power of Attorney

- Importance of Power of Attorney

- Steps to Obtain Power of Attorney in Oregon

- Step 1: Determine the Type of Power of Attorney You Need

- Question-answer:

- What is a power of attorney?

- Why would I need a power of attorney in Oregon?

- How do I get a power of attorney in Oregon?

- Who can be my agent in Oregon?

- What powers can I grant in a power of attorney in Oregon?

Granting someone power of attorney can be an important decision, allowing them to make legal and financial decisions on your behalf. In Oregon, the process of obtaining power of attorney involves several steps to ensure that the document is legally binding and accurately reflects your wishes.

Step 1: Determine the Type of Power of Attorney

Before you begin the process, it’s important to understand the different types of power of attorney available in Oregon. The two main types are financial power of attorney and healthcare power of attorney. Financial power of attorney grants someone the authority to make financial decisions on your behalf, while healthcare power of attorney allows them to make medical decisions.

Step 2: Choose an Agent

Next, you’ll need to select an agent who will act on your behalf. This should be someone you trust implicitly, as they will have significant control over your affairs. It’s important to have an open and honest conversation with your chosen agent to ensure they understand your wishes and are willing to take on the responsibility.

Step 3: Draft the Power of Attorney Document

Once you’ve determined the type of power of attorney and chosen an agent, it’s time to draft the document. In Oregon, there are specific requirements for a power of attorney to be legally valid. The document must be in writing, signed by you (the principal), and witnessed by two adults who are not named as agents in the document.

Step 4: Execute the Power of Attorney

After the document has been drafted, it must be executed properly to ensure its validity. You (the principal) must sign the document in the presence of a notary public, who will then notarize the document. This step is crucial, as a power of attorney that is not properly executed may not be legally binding.

Step 5: Distribute Copies of the Power of Attorney

Once the power of attorney has been executed, it’s important to distribute copies to relevant parties. This may include banks, healthcare providers, and other institutions that may need to verify the authority of your agent. It’s also a good idea to keep a copy for yourself and inform your loved ones of the existence and location of the document.

By following these steps, you can ensure that your power of attorney is legally valid and accurately reflects your wishes. It’s always a good idea to consult with an attorney who specializes in estate planning to ensure that you have considered all relevant factors and that your power of attorney meets all legal requirements in Oregon.

Understanding Power of Attorney

A power of attorney is a legal document that grants someone the authority to act on behalf of another person, known as the principal. This authority can be broad or limited, depending on the specific powers granted in the document.

Power of attorney is commonly used in situations where the principal is unable to make decisions or take actions on their own, either due to physical or mental incapacity, or because they are unavailable or absent. The person granted power of attorney, known as the agent or attorney-in-fact, is entrusted with making decisions and acting in the best interests of the principal.

There are different types of power of attorney, each serving a specific purpose. The most common types include:

- General Power of Attorney: This grants broad authority to the agent to make decisions and take actions on behalf of the principal. It is often used for financial and legal matters.

- Limited Power of Attorney: This grants specific powers to the agent for a limited period of time or for a specific purpose. It is commonly used for real estate transactions or medical decisions.

- Durable Power of Attorney: This remains in effect even if the principal becomes incapacitated. It is often used to ensure that someone can make decisions on behalf of the principal if they are unable to do so themselves.

Having a power of attorney in place is important for several reasons. It allows the principal to choose someone they trust to make decisions on their behalf, ensuring that their wishes are carried out. It also provides a legal framework for the agent to act, protecting them from liability and providing clarity on their authority.

To obtain a power of attorney in Oregon, there are several steps that need to be followed. These include determining the type of power of attorney needed, selecting an agent, drafting the document, and signing it in the presence of a notary public. It is recommended to consult with an attorney to ensure that the power of attorney meets all legal requirements and addresses the specific needs of the principal.

What is Power of Attorney?

Power of Attorney is a legal document that grants someone the authority to act on behalf of another person in making financial, legal, and healthcare decisions. The person granting the power is known as the principal, while the person receiving the power is called the agent or attorney-in-fact.

Power of Attorney is an important tool that allows individuals to plan for the possibility of incapacity or the need for assistance in managing their affairs. It can be used in various situations, such as when someone is traveling abroad, facing a medical emergency, or simply wants to ensure that their financial matters are taken care of in their absence.

By granting Power of Attorney, the principal gives the agent the legal authority to make decisions and take actions on their behalf. This can include managing bank accounts, paying bills, buying or selling property, making healthcare decisions, and signing legal documents.

It is crucial to choose a trustworthy and reliable agent when granting Power of Attorney, as they will have significant control over the principal’s affairs. It is also important to clearly define the scope of the agent’s authority and any limitations or conditions that may apply.

Power of Attorney can be a valuable tool in ensuring that an individual’s wishes are carried out and their best interests are protected. It provides peace of mind and allows for the smooth management of affairs in times of need or incapacity.

Types of Power of Attorney

When it comes to power of attorney, there are several different types that you should be aware of. Each type serves a specific purpose and grants different levels of authority to the appointed agent. Here are the most common types of power of attorney:

1. General Power of Attorney:

A general power of attorney grants broad authority to the agent, allowing them to make financial and legal decisions on behalf of the principal. This type of power of attorney is often used when the principal is unable to handle their own affairs due to illness, disability, or absence.

2. Limited Power of Attorney:

A limited power of attorney, also known as a special power of attorney, grants the agent specific powers and limits their authority to a particular task or time period. For example, the principal may grant the agent the power to sell a property on their behalf, but only for a specified period of time.

3. Durable Power of Attorney:

A durable power of attorney remains in effect even if the principal becomes incapacitated or mentally incompetent. This type of power of attorney is often used to ensure that someone can continue to make decisions on behalf of the principal if they are unable to do so themselves.

4. Springing Power of Attorney:

A springing power of attorney only becomes effective under specific circumstances, such as when the principal becomes incapacitated. This type of power of attorney is often used as a safeguard to ensure that the agent’s authority is only granted when necessary.

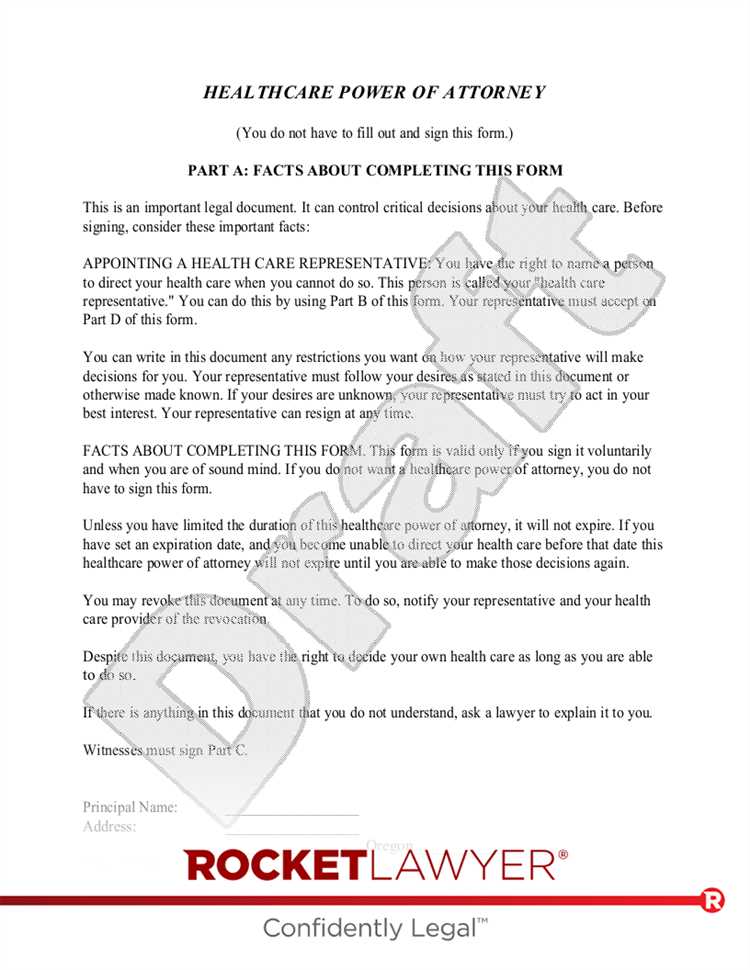

5. Healthcare Power of Attorney:

A healthcare power of attorney, also known as a medical power of attorney, grants the agent the authority to make healthcare decisions on behalf of the principal. This type of power of attorney is often used when the principal is unable to make their own medical decisions due to illness or incapacity.

It is important to carefully consider the type of power of attorney that best suits your needs and consult with a legal professional to ensure that it is properly executed and meets all legal requirements.

Importance of Power of Attorney

A Power of Attorney is a legal document that grants someone the authority to act on your behalf in financial and legal matters. It is an important tool that can provide peace of mind and protection for you and your loved ones.

There are several reasons why having a Power of Attorney is important:

1. Decision-making in case of incapacity:

Life is unpredictable, and there may come a time when you are unable to make decisions for yourself due to illness, injury, or old age. In such situations, a Power of Attorney allows you to appoint a trusted person to make decisions on your behalf. This ensures that your affairs are handled according to your wishes and best interests.

2. Avoiding court intervention:

Without a Power of Attorney, if you become incapacitated, your loved ones may have to go through a lengthy and expensive court process to obtain the authority to make decisions for you. By having a Power of Attorney in place, you can avoid the need for court intervention and the associated costs and delays.

3. Managing financial matters:

A Power of Attorney can be specifically tailored to grant authority over financial matters. This allows your chosen agent to manage your bank accounts, pay bills, file taxes, and handle other financial transactions on your behalf. It ensures that your financial affairs are properly managed even if you are unable to do so yourself.

4. Ensuring healthcare decisions:

In addition to financial matters, a Power of Attorney can also address healthcare decisions. You can grant your agent the authority to make medical decisions for you, including consenting to or refusing medical treatment, choosing healthcare providers, and accessing your medical records. This ensures that your healthcare preferences are respected and followed.

5. Protecting against fraud and abuse:

By appointing a trusted person as your agent, you can help protect yourself against potential fraud and abuse. A Power of Attorney allows you to choose someone who will act in your best interests and hold them accountable for their actions. It provides a legal framework for oversight and protection.

Steps to Obtain Power of Attorney in Oregon

Obtaining a power of attorney in Oregon is a straightforward process that involves several important steps. By following these steps, you can ensure that you have the legal authority to make decisions on behalf of another person.

Step 1: Determine the Type of Power of Attorney You Need

Before you can begin the process of obtaining a power of attorney in Oregon, you need to determine the specific type of power of attorney you need. There are several different types, including:

- Durable Power of Attorney: This type of power of attorney remains in effect even if the person granting it becomes incapacitated.

- General Power of Attorney: This type of power of attorney grants broad authority to make decisions on behalf of another person.

- Limited Power of Attorney: This type of power of attorney grants specific authority to perform certain tasks or make certain decisions on behalf of another person.

Step 2: Choose an Agent

Once you have determined the type of power of attorney you need, you will need to choose an agent. An agent is the person who will be granted the authority to make decisions on your behalf. It is important to choose someone you trust and who is capable of handling the responsibilities associated with being an agent.

Step 3: Draft the Power of Attorney Document

After choosing an agent, you will need to draft the power of attorney document. This document should clearly state the powers and limitations of the agent, as well as any specific instructions or preferences you have regarding decision-making.

Step 4: Sign and Notarize the Document

Once the power of attorney document has been drafted, it must be signed and notarized. This ensures that the document is legally binding and enforceable.

Step 5: Distribute Copies of the Document

After the document has been signed and notarized, it is important to distribute copies to all relevant parties. This includes the agent, any institutions or individuals who may need to rely on the power of attorney, and your own personal records.

Step 6: Review and Update as Needed

Finally, it is important to periodically review and update your power of attorney document as needed. Circumstances may change over time, and it is important to ensure that your power of attorney accurately reflects your wishes and current situation.

By following these steps, you can obtain a power of attorney in Oregon and have the peace of mind knowing that your affairs will be handled according to your wishes.

Step 1: Determine the Type of Power of Attorney You Need

Before obtaining a power of attorney in Oregon, it is important to determine the specific type of power of attorney you need. There are different types of power of attorney, each serving a different purpose and granting different levels of authority.

General Power of Attorney: This type of power of attorney grants broad authority to the appointed person, known as the agent or attorney-in-fact, to make financial and legal decisions on behalf of the principal. It is typically used when the principal wants to give someone else the authority to handle their affairs temporarily or in case of incapacity.

Limited Power of Attorney: A limited power of attorney grants the agent specific powers and authority to act on behalf of the principal for a limited period of time or for specific transactions. This type of power of attorney is commonly used when the principal needs assistance with a specific task or transaction, such as selling a property or managing investments.

Healthcare Power of Attorney: A healthcare power of attorney, also known as a medical power of attorney or healthcare proxy, grants the agent the authority to make medical decisions on behalf of the principal if they become unable to make decisions for themselves. This type of power of attorney is important for individuals who want to ensure their healthcare wishes are followed in case of incapacity.

Durable Power of Attorney: A durable power of attorney remains in effect even if the principal becomes incapacitated. This means that the agent can continue to make decisions on behalf of the principal even if they are unable to do so themselves. It is important to specify in the power of attorney document that it is durable if this is the desired effect.

Springing Power of Attorney: A springing power of attorney only becomes effective if a specific event or condition occurs, such as the incapacity of the principal. This type of power of attorney is often used when the principal wants to ensure that their agent can only act on their behalf if they are unable to do so themselves.

Once you have determined the type of power of attorney you need, you can proceed with the necessary steps to obtain it in Oregon.

Question-answer:

What is a power of attorney?

A power of attorney is a legal document that allows someone to make decisions on behalf of another person, known as the principal.

Why would I need a power of attorney in Oregon?

You may need a power of attorney in Oregon if you want someone to handle your financial or legal affairs in case you become incapacitated or unable to make decisions on your own.

How do I get a power of attorney in Oregon?

To get a power of attorney in Oregon, you need to follow these steps: 1. Choose an agent 2. Determine the powers you want to grant 3. Fill out the power of attorney form 4. Sign the form in front of a notary public 5. Give a copy of the form to your agent

Who can be my agent in Oregon?

Your agent can be anyone you trust to make decisions on your behalf. It can be a family member, a friend, or even a professional such as a lawyer or accountant.

What powers can I grant in a power of attorney in Oregon?

In Oregon, you can grant a wide range of powers in a power of attorney, including the power to manage your finances, make healthcare decisions, sell or buy property, and handle legal matters.