- Section 1: Understanding the Basics

- What is a 1099 Employee?

- Benefits of Hiring a 1099 Employee

- Legal Considerations for Hiring a 1099 Employee

- Section 2: Drafting the Contract

- Question-answer:

- What is a 1099 employee?

- Why do I need a contract for a 1099 employee?

- What should be included in a contract for a 1099 employee?

- Can I use a template for creating a contract for a 1099 employee?

- What happens if there is a dispute between the company and the 1099 employee?

When hiring a 1099 employee, it is crucial to have a well-drafted contract in place. This contract serves as a legally binding agreement between you and the independent contractor, outlining the terms and conditions of the working relationship. Creating a contract may seem daunting, but with this step-by-step guide, you can ensure that your contract covers all the necessary aspects.

Step 1: Define the Parties Involved

Start by clearly identifying the parties involved in the contract. This includes your company or organization, referred to as the “Client,” and the independent contractor, referred to as the “Contractor.” Include their legal names, addresses, and contact information to establish their identities.

Step 2: Specify the Scope of Work

Next, outline the specific services or tasks that the Contractor will be responsible for. Be as detailed as possible to avoid any confusion or misunderstandings. Include information such as project timelines, deliverables, and any specific requirements or expectations.

Step 3: Determine Compensation and Payment Terms

Clearly state the compensation amount that the Contractor will receive for their services. Specify whether it will be an hourly rate, a fixed fee, or based on a specific milestone. Additionally, outline the payment terms, including when and how the Contractor will be paid.

Step 4: Address Confidentiality and Non-Disclosure

If your project involves sensitive information or trade secrets, it is essential to include a confidentiality and non-disclosure clause in the contract. This clause ensures that the Contractor will not disclose any confidential information to third parties and will maintain the confidentiality of the project.

Step 5: Include Intellectual Property Rights

If the Contractor will be creating any intellectual property during the course of their work, such as software code or designs, it is crucial to address the ownership and rights to that intellectual property. Specify whether the Contractor will retain ownership or if it will be transferred to the Client.

Step 6: Outline Termination and Dispute Resolution

Include provisions for terminating the contract, such as notice periods or conditions that may lead to termination. Additionally, outline the process for resolving any disputes that may arise during the course of the contract, such as mediation or arbitration.

By following these steps and including all the necessary clauses, you can create a comprehensive contract for your 1099 employee. Remember to review the contract with a legal professional to ensure its compliance with local laws and regulations.

Section 1: Understanding the Basics

Before creating a contract for a 1099 employee, it is important to understand the basics of what a 1099 employee is and the benefits and legal considerations associated with hiring one.

What is a 1099 Employee?

A 1099 employee, also known as an independent contractor, is an individual who provides services to a company or organization on a contract basis. Unlike traditional employees, 1099 employees are not considered employees for tax purposes and are responsible for paying their own taxes.

Benefits of Hiring a 1099 Employee

There are several benefits to hiring a 1099 employee. Firstly, it provides flexibility for both the employer and the employee. The employer can hire a 1099 employee for a specific project or period of time, without the long-term commitment of hiring a full-time employee. For the employee, being a 1099 worker allows for greater control over their work schedule and the ability to work with multiple clients.

Additionally, hiring a 1099 employee can be cost-effective for employers. Since 1099 employees are responsible for their own taxes, employers do not have to provide benefits such as health insurance or paid time off. This can result in significant cost savings for the employer.

Legal Considerations for Hiring a 1099 Employee

When hiring a 1099 employee, it is important to be aware of the legal considerations involved. Firstly, it is crucial to properly classify the worker as an independent contractor and not an employee. Misclassifying a worker can lead to legal and financial consequences.

Furthermore, it is important to clearly define the terms of the working relationship in a contract. This includes outlining the scope of work, payment terms, and any confidentiality or non-compete agreements. It is also important to ensure that the contract complies with all applicable laws and regulations.

Lastly, it is important to note that 1099 employees do not receive the same legal protections and benefits as traditional employees. They are not entitled to minimum wage, overtime pay, or unemployment benefits. It is important to consult with legal counsel to ensure compliance with all relevant laws and regulations.

By understanding the basics of hiring a 1099 employee and the associated benefits and legal considerations, you can create a contract that protects both parties and ensures a successful working relationship.

What is a 1099 Employee?

A 1099 employee, also known as an independent contractor, is an individual who provides services to a company or organization on a contract basis. Unlike traditional employees, 1099 employees are not considered employees for tax purposes and are not subject to the same tax withholding requirements as regular employees.

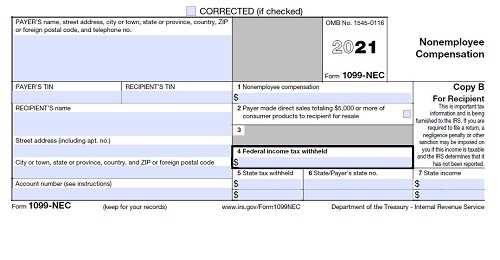

Instead of receiving a W-2 form at the end of the year, 1099 employees receive a Form 1099-MISC, which reports the income they earned from the company or organization. This form is used to report income earned as an independent contractor to the Internal Revenue Service (IRS).

1099 employees are responsible for paying their own taxes, including self-employment taxes, and are not eligible for benefits such as health insurance, retirement plans, or paid time off. They are also not protected by employment laws that apply to regular employees, such as minimum wage and overtime laws.

Companies often hire 1099 employees for specific projects or tasks that require specialized skills or expertise. This arrangement allows companies to access the skills they need without the long-term commitment and expenses associated with hiring a regular employee.

It’s important for both the company and the 1099 employee to clearly understand the nature of their relationship and the terms of their agreement. This is typically outlined in a contract, which specifies the scope of work, payment terms, and other important details.

Overall, hiring a 1099 employee can provide flexibility and cost savings for companies, while offering individuals the opportunity to work independently and potentially earn higher rates for their services.

Benefits of Hiring a 1099 Employee

When it comes to hiring employees, businesses have two options: hiring a W-2 employee or a 1099 employee. While both options have their advantages, hiring a 1099 employee can offer several benefits for businesses. Here are some of the key benefits of hiring a 1099 employee:

- Cost savings: One of the main advantages of hiring a 1099 employee is the potential cost savings for businesses. Unlike W-2 employees, 1099 employees are not entitled to benefits such as health insurance, paid time off, or retirement plans. This means that businesses can save on these expenses, which can significantly reduce their overall labor costs.

- Flexibility: Hiring a 1099 employee provides businesses with greater flexibility. Since 1099 employees are considered independent contractors, businesses can hire them on a project-by-project basis or for a specific duration. This allows businesses to scale their workforce up or down based on their needs, without the long-term commitment of hiring a W-2 employee.

- Specialized skills: 1099 employees often have specialized skills or expertise in a particular area. By hiring a 1099 employee, businesses can tap into this specialized knowledge without having to invest in training or hiring a full-time employee. This can be particularly beneficial for businesses that require specific skills for short-term projects or specialized tasks.

- Reduced administrative burden: Hiring a 1099 employee can also help reduce the administrative burden for businesses. Since 1099 employees are responsible for their own taxes and benefits, businesses do not have to withhold taxes or provide benefits like they would for W-2 employees. This can save businesses time and resources that would otherwise be spent on payroll and benefits administration.

- Increased productivity: 1099 employees are often highly motivated and focused on delivering results. Since they are typically paid based on the completion of specific tasks or projects, they have a strong incentive to perform well. This can lead to increased productivity and efficiency, as 1099 employees are driven to meet deadlines and exceed expectations.

Overall, hiring a 1099 employee can offer businesses a range of benefits, including cost savings, flexibility, access to specialized skills, reduced administrative burden, and increased productivity. However, it is important for businesses to carefully consider the legal implications and requirements of hiring a 1099 employee to ensure compliance with applicable laws and regulations.

Legal Considerations for Hiring a 1099 Employee

When hiring a 1099 employee, it is important to understand the legal considerations involved. Here are some key points to keep in mind:

1. Independent Contractor Status:

One of the most important legal considerations is determining the independent contractor status of the employee. It is crucial to ensure that the worker meets the criteria set by the Internal Revenue Service (IRS) to be classified as an independent contractor. This includes factors such as control over work, financial arrangement, and the nature of the relationship between the employer and the employee.

2. Written Contract:

Having a written contract is essential when hiring a 1099 employee. The contract should clearly outline the terms and conditions of the working relationship, including the scope of work, payment terms, and any specific obligations or responsibilities of both parties. This helps to establish a clear understanding and minimize any potential disputes in the future.

3. Compliance with Labor Laws:

Even though 1099 employees are considered independent contractors, it is still important to ensure compliance with labor laws. This includes adhering to minimum wage requirements, providing a safe working environment, and complying with any applicable state or federal regulations. Failure to comply with labor laws can result in legal consequences and penalties.

4. Intellectual Property Rights:

When hiring a 1099 employee, it is crucial to address the issue of intellectual property rights. The contract should clearly state who owns the intellectual property created by the employee during the course of their work. This helps to protect the employer’s rights and prevent any potential disputes over ownership in the future.

5. Insurance Coverage:

Another important legal consideration is insurance coverage. While 1099 employees are responsible for their own insurance, it is still important for the employer to ensure that they have adequate coverage. This includes liability insurance to protect against any potential claims or damages that may arise from the work performed by the employee.

6. Termination Clause:

Lastly, it is important to include a termination clause in the contract. This clause should outline the conditions under which either party can terminate the working relationship. It is important to clearly define the notice period and any potential penalties or consequences for early termination.

By considering these legal considerations when hiring a 1099 employee, employers can ensure compliance with the law and establish a clear and mutually beneficial working relationship.

Section 2: Drafting the Contract

Once you have a clear understanding of the basics of hiring a 1099 employee, it’s time to draft the contract. The contract is a legally binding agreement between you and the 1099 employee, outlining the terms and conditions of the working relationship. Here are some key elements to include in the contract:

| 1. Parties Involved: | Clearly state the names and contact information of both parties involved in the contract – the employer (you) and the 1099 employee. |

| 2. Scope of Work: | Define the specific tasks and responsibilities that the 1099 employee will be responsible for. Be as detailed as possible to avoid any confusion or misunderstandings. |

| 3. Payment Terms: | Specify the agreed-upon payment terms, including the rate of pay, frequency of payment, and any additional expenses or reimbursements that will be provided. |

| 4. Duration of Contract: | State the start and end dates of the contract, or if it is an ongoing arrangement, specify the notice period required to terminate the contract. |

| 5. Confidentiality and Non-Disclosure: | Include a clause that outlines the confidentiality obligations of the 1099 employee, ensuring that any sensitive information or trade secrets are protected. |

| 6. Intellectual Property: | Address ownership of any intellectual property created by the 1099 employee during the course of their work. Specify whether the employer or the employee retains the rights to the intellectual property. |

| 7. Termination Clause: | Outline the circumstances under which either party can terminate the contract, including any notice periods or penalties that may apply. |

| 8. Governing Law: | Specify the jurisdiction and governing law that will apply to the contract, in case of any legal disputes. |

It is important to consult with a legal professional when drafting the contract to ensure that it complies with all relevant laws and regulations. Once the contract is drafted, both parties should carefully review and sign it to indicate their agreement and understanding of the terms.

Remember, a well-drafted contract is essential for establishing a clear and mutually beneficial working relationship with your 1099 employee. It provides protection for both parties and helps to avoid any potential conflicts or misunderstandings in the future.

Question-answer:

What is a 1099 employee?

A 1099 employee, also known as an independent contractor, is a worker who is not considered an employee by the company they work for. Instead, they are self-employed and are responsible for paying their own taxes and benefits.

Why do I need a contract for a 1099 employee?

Having a contract for a 1099 employee is important because it outlines the terms and conditions of the working relationship between the company and the independent contractor. It helps protect both parties and ensures that both parties are clear on their responsibilities and expectations.

What should be included in a contract for a 1099 employee?

A contract for a 1099 employee should include the names and contact information of both parties, a description of the services to be provided, the payment terms and schedule, the duration of the contract, any confidentiality or non-disclosure agreements, and any other relevant terms and conditions.

Can I use a template for creating a contract for a 1099 employee?

Yes, using a template can be a helpful starting point for creating a contract for a 1099 employee. However, it is important to customize the template to fit the specific needs and requirements of your business and the independent contractor you are working with.

What happens if there is a dispute between the company and the 1099 employee?

If there is a dispute between the company and the 1099 employee, it is important to refer to the contract to see if there are any provisions for dispute resolution. If not, the parties may need to seek legal advice or mediation to resolve the dispute.