- Understanding inheritance tax

- What is inheritance tax?

- How does inheritance tax work?

- Who is subject to inheritance tax?

- Calculating inheritance tax

- What is the inheritance tax rate?

- How is the value of the estate determined?

- Question-answer:

- What is inheritance tax?

- How does inheritance tax work?

- Who is responsible for paying inheritance tax?

- Are there any exemptions or deductions for inheritance tax?

- What happens if inheritance tax is not paid?

- What is inheritance tax?

When it comes to planning for the future, understanding the intricacies of inheritance tax is crucial. Inheritance tax, also known as estate tax or death tax, is a tax imposed on the transfer of assets from a deceased person to their beneficiaries. It is important to have a clear understanding of how this tax works, as it can have a significant impact on the value of your estate and the amount of wealth you are able to pass on to your loved ones.

One of the key factors to consider when it comes to inheritance tax is the threshold at which it becomes applicable. In many countries, including the United States, there is a certain threshold below which no inheritance tax is due. However, once the value of the estate exceeds this threshold, the tax is applied at a certain rate. This rate can vary depending on the jurisdiction and the relationship between the deceased and the beneficiary.

It is also important to note that there are often exemptions and allowances that can help reduce the amount of inheritance tax payable. For example, many countries have a spouse exemption, which means that assets passing to a surviving spouse are not subject to inheritance tax. Additionally, there may be allowances for certain types of assets, such as business property or agricultural land, which can help reduce the tax liability.

Understanding the ins and outs of inheritance tax can be complex, but it is an essential part of estate planning. By familiarizing yourself with the rules and regulations surrounding this tax, you can ensure that your assets are distributed in accordance with your wishes and minimize the tax burden on your loved ones. So, whether you are planning your own estate or are the beneficiary of an inheritance, it is important to seek professional advice to navigate the complexities of inheritance tax and make informed decisions.

Understanding inheritance tax

Inheritance tax is a tax that is imposed on the transfer of assets from a deceased person to their beneficiaries. It is also known as the death tax or estate tax. The purpose of inheritance tax is to generate revenue for the government and to redistribute wealth.

When a person passes away, their estate, which includes all their assets and liabilities, is subject to inheritance tax. The tax is calculated based on the value of the estate at the time of death. The beneficiaries of the estate are responsible for paying the tax.

There are certain exemptions and allowances that can reduce the amount of inheritance tax owed. For example, there is usually no inheritance tax on assets passed to a spouse or civil partner. Additionally, there is an inheritance tax threshold, also known as the nil-rate band, which is the amount of the estate that is exempt from tax.

The rules and regulations surrounding inheritance tax can be complex, and it is important to seek professional advice to ensure compliance. Estate planning and tax mitigation strategies can help minimize the amount of inheritance tax that needs to be paid.

Understanding inheritance tax is crucial for individuals who are planning their estate or who are beneficiaries of an estate. By understanding the tax implications, individuals can make informed decisions and take steps to minimize their tax liability.

What is inheritance tax?

Inheritance tax, also known as estate tax or death tax, is a tax imposed on the transfer of assets from a deceased person to their heirs or beneficiaries. It is a tax that is levied on the value of the estate left behind by the deceased individual.

The purpose of inheritance tax is to generate revenue for the government and to redistribute wealth. It is a way for the government to collect taxes on the transfer of wealth from one generation to the next.

Inheritance tax is different from other types of taxes, such as income tax or sales tax, because it is based on the value of the assets being transferred rather than the income or purchases made by the individual. It is a one-time tax that is paid by the heirs or beneficiaries when they receive their inheritance.

The amount of inheritance tax that is owed depends on the value of the estate and the tax rate that is applied. The tax rate can vary depending on the country or jurisdiction, and there may be exemptions or deductions available that can reduce the amount of tax owed.

Inheritance tax can be a complex and controversial topic, as it involves the transfer of wealth and can have a significant impact on the financial well-being of the heirs or beneficiaries. It is important for individuals to understand the laws and regulations surrounding inheritance tax in their country or jurisdiction to ensure that they are in compliance and to plan their estate accordingly.

| Pros | Cons |

|---|---|

| Generates revenue for the government | Can be a significant financial burden for heirs or beneficiaries |

| Redistributes wealth | Can be complex and difficult to understand |

| Can help prevent the concentration of wealth | Can lead to disputes and conflicts among family members |

Overall, inheritance tax is an important aspect of the tax system that helps to ensure a fair and equitable distribution of wealth. It is important for individuals to be aware of the laws and regulations surrounding inheritance tax in their country or jurisdiction and to plan their estate accordingly to minimize the tax burden on their heirs or beneficiaries.

How does inheritance tax work?

Inheritance tax is a tax that is imposed on the transfer of assets from a deceased person to their beneficiaries. It is based on the value of the estate left behind by the deceased individual. The tax is typically paid by the beneficiaries, who receive the assets.

The first step in understanding how inheritance tax works is to determine the value of the estate. This includes all assets owned by the deceased, such as property, investments, and personal belongings. Debts and liabilities are subtracted from the total value of the estate to arrive at the taxable amount.

Once the value of the estate has been determined, the next step is to calculate the inheritance tax due. The tax rate varies depending on the jurisdiction and the relationship between the deceased and the beneficiaries. In some cases, certain assets may be exempt from inheritance tax, such as a family home or assets left to a spouse or charity.

After the inheritance tax has been calculated, it is the responsibility of the beneficiaries to pay the tax. They may need to sell assets or use funds from the estate to cover the tax liability. In some cases, beneficiaries may choose to pay the tax in installments over a period of time.

It is important to note that inheritance tax laws and regulations can vary significantly between countries and jurisdictions. It is advisable to seek professional advice or consult with a tax specialist to ensure compliance with the applicable laws and to understand the specific rules and exemptions that may apply in a particular situation.

Who is subject to inheritance tax?

Inheritance tax is a tax that is imposed on the transfer of assets from a deceased person to their beneficiaries. It is important to note that not everyone is subject to inheritance tax. The tax laws vary from country to country, and each country has its own rules and regulations regarding who is liable to pay inheritance tax.

In general, inheritance tax is typically paid by the beneficiaries of the deceased person’s estate. This includes individuals who receive assets such as money, property, or investments from the deceased person. The tax is usually calculated based on the value of the assets received and the relationship between the deceased person and the beneficiary.

However, there are certain exemptions and thresholds that determine whether someone is subject to inheritance tax. For example, many countries have a threshold or exemption limit, below which no inheritance tax is payable. This means that if the value of the estate falls below the threshold, the beneficiaries may not have to pay any inheritance tax.

In addition, some countries have specific rules regarding certain types of assets or beneficiaries. For instance, some countries may exempt certain types of assets, such as a family home, from inheritance tax. Others may provide special allowances or exemptions for spouses or civil partners.

It is important to consult the specific inheritance tax laws of your country to determine who is subject to inheritance tax. In some cases, it may be necessary to seek professional advice from a tax advisor or lawyer to ensure compliance with the tax laws and to minimize any potential tax liability.

Overall, inheritance tax is a complex area of taxation that requires careful consideration and planning. Understanding who is subject to inheritance tax and the applicable rules and exemptions can help individuals and families navigate the tax implications of transferring assets to their beneficiaries.

Calculating inheritance tax

Calculating inheritance tax can be a complex process that involves determining the value of the estate and applying the appropriate tax rate. Here are the key steps involved in calculating inheritance tax:

Step 1: Determine the value of the estate

The first step in calculating inheritance tax is to determine the total value of the deceased person’s estate. This includes all assets such as property, investments, bank accounts, and personal belongings. It is important to accurately assess the value of each asset to ensure the correct amount of tax is paid.

Step 2: Deduct any exemptions and reliefs

Once the value of the estate is determined, certain exemptions and reliefs may be applied to reduce the taxable amount. These can include exemptions for assets passed to a spouse or civil partner, charitable donations, and business assets. It is important to consult with a tax professional to ensure all eligible exemptions and reliefs are claimed.

Step 3: Calculate the taxable amount

After deducting any exemptions and reliefs, the remaining value of the estate is considered the taxable amount. This is the amount on which inheritance tax will be calculated.

Step 4: Apply the inheritance tax rate

The next step is to apply the appropriate inheritance tax rate to the taxable amount. In the UK, the standard inheritance tax rate is 40%. However, there may be lower rates or exemptions available depending on the circumstances, such as the value of the estate and any applicable reliefs.

Step 5: Consider any additional factors

In addition to the basic calculation, there may be additional factors to consider when calculating inheritance tax. For example, if the deceased person made any gifts within the seven years prior to their death, these may be subject to inheritance tax. It is important to take into account any relevant factors to ensure accurate tax calculations.

What is the inheritance tax rate?

The inheritance tax rate is the percentage of the value of an estate that is subject to taxation upon the death of the owner. The rate varies depending on the country and jurisdiction in which the estate is located.

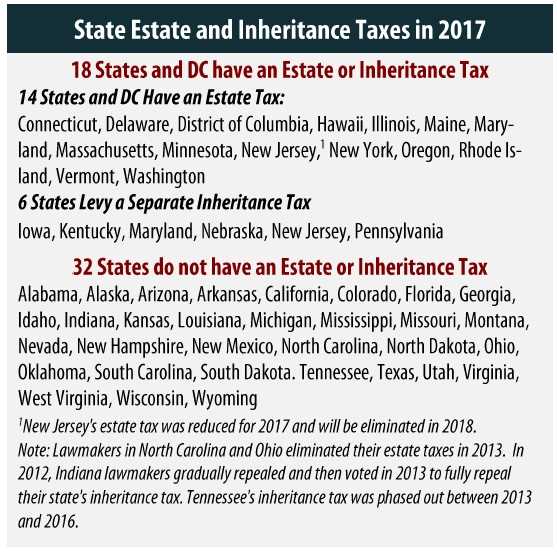

In the United States, for example, the federal inheritance tax rate can range from 18% to 40% of the taxable estate. However, it’s important to note that not all estates are subject to inheritance tax, as there are certain exemptions and thresholds that determine whether or not an estate is taxable.

In the United Kingdom, the inheritance tax rate is currently set at 40% for estates valued above the nil-rate band threshold, which is £325,000. However, there are additional allowances and exemptions that can reduce the overall tax liability for certain individuals, such as the spouse or civil partner exemption.

Other countries may have different inheritance tax rates and thresholds. It’s important to consult with a tax professional or legal advisor to understand the specific rules and regulations that apply to your situation.

It’s also worth noting that inheritance tax rates can change over time, as governments may adjust tax laws and regulations. Staying informed about any changes in the inheritance tax rate is crucial for effective estate planning and minimizing tax liabilities.

How is the value of the estate determined?

The value of the estate is determined by calculating the total worth of all the assets owned by the deceased individual at the time of their death. This includes any property, investments, savings, and personal belongings that they owned.

To determine the value of the estate, a thorough inventory of all the assets must be conducted. This involves gathering information about the current market value of each asset, taking into account any outstanding debts or liabilities that may need to be deducted.

It is important to note that certain assets may be exempt from the calculation of the estate value, such as assets held in a trust or assets that are jointly owned with another individual. Additionally, any debts or mortgages on the property may also be deducted from the overall value.

Once the total value of the estate has been determined, it is used to calculate the inheritance tax liability. The inheritance tax rate is applied to the value of the estate above a certain threshold, which varies depending on the jurisdiction.

It is crucial to accurately determine the value of the estate, as any inaccuracies or omissions can result in penalties or legal issues. Seeking professional advice from an estate planner or tax advisor can help ensure that the valuation process is done correctly and in compliance with the applicable laws and regulations.

Question-answer:

What is inheritance tax?

Inheritance tax is a tax that is imposed on the transfer of assets from a deceased person to their heirs or beneficiaries.

How does inheritance tax work?

Inheritance tax is calculated based on the value of the assets being transferred and the relationship between the deceased person and the heir or beneficiary. The tax rate varies depending on the jurisdiction and the amount of the inheritance.

Who is responsible for paying inheritance tax?

The responsibility for paying inheritance tax usually falls on the heirs or beneficiaries who receive the assets. However, in some cases, the estate of the deceased person may be responsible for paying the tax before the assets are distributed.

Are there any exemptions or deductions for inheritance tax?

Yes, many jurisdictions have exemptions or deductions for certain types of assets or for transfers to certain individuals, such as spouses or charitable organizations. These exemptions and deductions can help reduce the amount of inheritance tax that needs to be paid.

What happens if inheritance tax is not paid?

If inheritance tax is not paid, it can result in penalties and interest being added to the amount owed. In some cases, the assets may be seized or sold to cover the tax debt. It is important to understand and fulfill the obligations related to inheritance tax to avoid any legal consequences.

What is inheritance tax?

Inheritance tax is a tax that is imposed on the transfer of assets or property from a deceased person to their heirs or beneficiaries.