- Overview of Inheritance Tax in South Carolina

- Understanding Inheritance Tax

- Applicability of Inheritance Tax in South Carolina

- Exemptions and Rates

- Exemptions from Inheritance Tax in South Carolina

- Question-answer:

- What is an inheritance tax?

- Does South Carolina have an inheritance tax?

- Are there any taxes on inherited property in South Carolina?

- What are the federal estate tax exemptions in South Carolina?

When it comes to estate planning, one important consideration is whether or not your state has an inheritance tax. In South Carolina, the good news is that there is no inheritance tax. This means that when you pass away, your heirs will not be required to pay a tax on the assets they inherit from you.

This is great news for individuals and families who want to pass on their wealth to their loved ones without the burden of additional taxes. Without an inheritance tax, your beneficiaries can receive their inheritance in full, allowing them to use the assets as they see fit.

It’s important to note, however, that South Carolina does have an estate tax. The estate tax is a tax on the total value of a person’s estate at the time of their death. Currently, the estate tax exemption in South Carolina is set at $5.49 million. This means that if your estate is valued at less than $5.49 million, you will not owe any estate tax.

Overall, South Carolina’s lack of an inheritance tax is a positive aspect for individuals and families who want to ensure that their loved ones receive their full inheritance. By understanding the tax laws in your state, you can make informed decisions about your estate planning and provide for your heirs in the most efficient way possible.

Overview of Inheritance Tax in South Carolina

Inheritance tax is a tax that is imposed on the transfer of assets from a deceased person to their beneficiaries. In South Carolina, however, there is no inheritance tax. This means that beneficiaries in South Carolina do not have to pay any tax on the assets they inherit.

This is different from an estate tax, which is a tax imposed on the total value of a deceased person’s estate. South Carolina does not have an estate tax either. Therefore, beneficiaries in South Carolina do not have to worry about paying any taxes on the assets they receive.

It is important to note that even though South Carolina does not have an inheritance tax or an estate tax, there may still be federal tax implications for beneficiaries. The federal government imposes a federal estate tax on estates that exceed a certain value. However, this tax only applies to estates that are worth more than the federal estate tax exemption amount, which is quite high.

Overall, South Carolina is a favorable state for beneficiaries when it comes to taxes on inherited assets. With no inheritance tax or estate tax, beneficiaries can receive their inheritance without having to worry about any tax obligations to the state. However, it is always a good idea to consult with a tax professional to understand the federal tax implications and ensure compliance with any applicable tax laws.

Understanding Inheritance Tax

Inheritance tax is a tax that is imposed on the transfer of assets from a deceased person to their heirs or beneficiaries. It is important to understand how inheritance tax works in order to properly plan for the distribution of assets and minimize any potential tax liabilities.

When a person passes away, their estate, which includes all of their assets, is subject to inheritance tax. The tax is calculated based on the value of the assets being transferred and the relationship between the deceased person and the heir or beneficiary.

In South Carolina, inheritance tax is not imposed. However, it is important to note that there is a federal estate tax that may apply to larger estates. The federal estate tax is a tax on the transfer of property at death and is based on the value of the estate.

It is also important to understand that inheritance tax is different from estate tax. While inheritance tax is imposed on the recipient of the assets, estate tax is imposed on the estate itself. Estate tax is typically paid by the estate before any assets are distributed to the heirs or beneficiaries.

When planning for the distribution of assets, it is important to consider the potential tax implications. Consulting with a qualified estate planning attorney can help ensure that your assets are distributed in the most tax-efficient manner possible.

Overall, understanding inheritance tax is crucial for anyone who is involved in estate planning or who may be receiving assets from a deceased person. By understanding the tax laws and regulations, individuals can make informed decisions and minimize any potential tax liabilities.

Applicability of Inheritance Tax in South Carolina

In South Carolina, an inheritance tax is imposed on the transfer of property from a deceased person to their beneficiaries. This tax is applicable to both residents and non-residents of the state, as long as the property being transferred is located within South Carolina.

It is important to note that not all inheritances are subject to the inheritance tax. The tax is only applicable if the total value of the estate exceeds a certain threshold, which is determined by the state. If the value of the estate falls below this threshold, no inheritance tax is owed.

The inheritance tax rates in South Carolina vary depending on the relationship between the deceased person and the beneficiary. Spouses and children are generally subject to lower tax rates compared to other beneficiaries, such as siblings or unrelated individuals.

It is also worth mentioning that certain types of property are exempt from the inheritance tax in South Carolina. This includes property that is transferred to a surviving spouse, property that is transferred to a charitable organization, and property that is transferred to the state or its political subdivisions.

When it comes to the administration of the inheritance tax, it is the responsibility of the personal representative of the deceased person’s estate to file the necessary tax returns and pay any applicable taxes. Failure to comply with these requirements can result in penalties and interest being imposed.

Exemptions and Rates

In South Carolina, there are certain exemptions and rates that apply to the inheritance tax. These exemptions determine whether or not an individual is required to pay the tax on their inherited assets.

Firstly, it is important to note that spouses are exempt from paying inheritance tax in South Carolina. This means that if a spouse inherits assets from their deceased partner, they will not be subject to the tax.

Additionally, there is a specific exemption for children and grandchildren. In South Carolina, if a child or grandchild inherits assets from a deceased parent or grandparent, they are also exempt from paying the inheritance tax.

Other exemptions include charitable organizations and certain types of trusts. If an inheritance is left to a qualified charitable organization, the tax does not apply. Similarly, if the assets are held in a trust that meets specific criteria, the tax may be waived.

For individuals who are not exempt from the inheritance tax, the rates vary depending on the value of the assets being inherited. The tax rates range from 0% to 16%.

Here is a breakdown of the tax rates based on the value of the inherited assets:

| Value of Inherited Assets | Tax Rate |

|---|---|

| Up to $10,000 | 0% |

| $10,001 – $50,000 | 5% |

| $50,001 – $100,000 | 6% |

| $100,001 – $200,000 | 7% |

| $200,001 – $300,000 | 8% |

| $300,001 – $400,000 | 9% |

| $400,001 – $500,000 | 10% |

| $500,001 – $600,000 | 11% |

| $600,001 – $700,000 | 12% |

| $700,001 – $800,000 | 13% |

| $800,001 – $900,000 | 14% |

| $900,001 – $1,000,000 | 15% |

| Above $1,000,000 | 16% |

It is important to consult with a tax professional or attorney to fully understand the exemptions and rates that apply to your specific situation in South Carolina.

Exemptions from Inheritance Tax in South Carolina

When it comes to inheritance tax in South Carolina, there are certain exemptions that can help reduce or eliminate the tax burden for beneficiaries. These exemptions are designed to protect certain types of assets and ensure that they can be passed on to heirs without incurring additional taxes.

One of the main exemptions from inheritance tax in South Carolina is the exemption for spouses. When a spouse inherits assets from their deceased partner, they are not subject to inheritance tax. This exemption recognizes the importance of spousal inheritance and aims to provide financial security for surviving spouses.

Another exemption from inheritance tax in South Carolina is the exemption for charitable organizations. If assets are left to a qualified charitable organization, they are not subject to inheritance tax. This exemption encourages philanthropy and supports the work of charitable organizations in the state.

Additionally, certain types of property are exempt from inheritance tax in South Carolina. This includes property that is classified as agricultural property, such as farmland or timberland. The exemption for agricultural property aims to support the agricultural industry in the state and ensure that family farms can be passed down through generations.

Furthermore, there is an exemption for property that is classified as “family-owned.” This exemption applies to property that has been owned and used by the same family for at least five years prior to the owner’s death. The exemption for family-owned property recognizes the importance of preserving family legacies and allows for the smooth transfer of property within families.

It is important to note that these exemptions are subject to certain limitations and conditions. For example, the exemption for family-owned property may not apply if the property is sold within three years of the owner’s death. Additionally, the exemption for agricultural property may only apply if the property meets certain size and use requirements.

Question-answer:

What is an inheritance tax?

An inheritance tax is a tax imposed on the transfer of assets from a deceased person to their heirs or beneficiaries.

Does South Carolina have an inheritance tax?

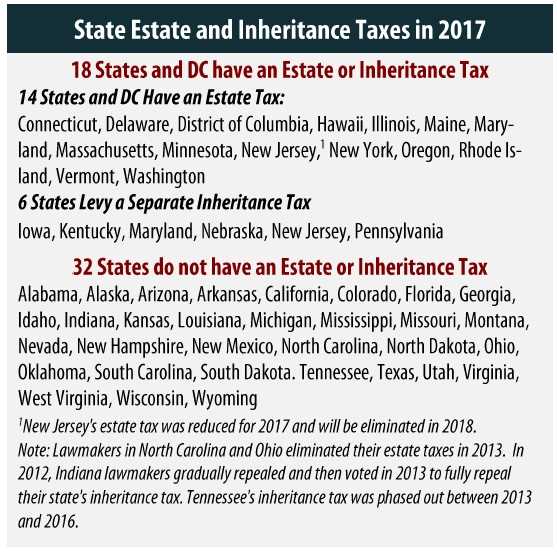

No, South Carolina does not have an inheritance tax. Inheritance taxes are imposed at the state level, and South Carolina is one of the states that does not levy this tax.

Are there any taxes on inherited property in South Carolina?

No, there are no specific taxes on inherited property in South Carolina. However, it is important to note that inherited property may be subject to federal estate taxes if the estate exceeds a certain value.

What are the federal estate tax exemptions in South Carolina?

In 2021, the federal estate tax exemption is $11.7 million per individual or $23.4 million for a married couple. This means that estates below these thresholds are not subject to federal estate taxes. It is important to consult with a tax professional for specific guidance on estate tax planning.