- Understanding Inheritance Tax in Massachusetts

- What is an Inheritance Tax?

- Is There an Inheritance Tax in Massachusetts?

- How Does the Inheritance Tax Work in Massachusetts?

- Exemptions and Rates for Inheritance Tax in Massachusetts

- Exemptions from Inheritance Tax in Massachusetts

- Rate of Inheritance Tax in Massachusetts

- Question-answer:

- What is an inheritance tax?

- Does Massachusetts have an inheritance tax?

- Are there any taxes on inherited property in Massachusetts?

- What are the tax laws regarding inheritance in Massachusetts?

- What is the threshold for federal estate taxes in Massachusetts?

When it comes to estate planning, understanding the tax implications is crucial. One question that often arises is whether Massachusetts has an inheritance tax. In this article, we will explore the topic and provide you with the information you need.

First and foremost, it is important to note that Massachusetts does not have an inheritance tax. An inheritance tax is a tax imposed on the person who inherits the property or assets, whereas an estate tax is imposed on the estate itself. Massachusetts, however, does have an estate tax.

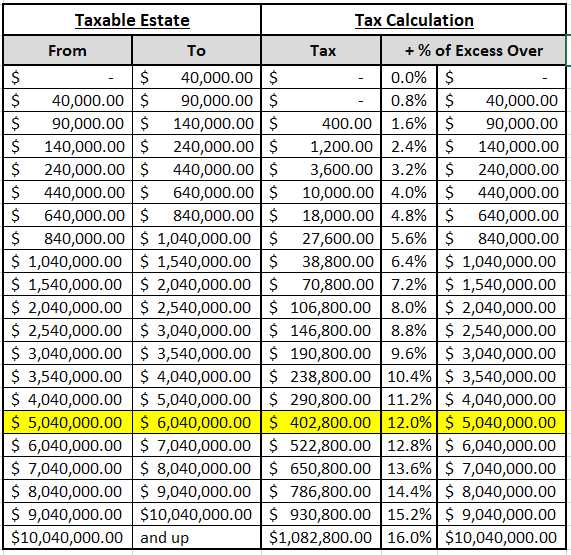

The Massachusetts estate tax is a tax on the transfer of assets upon death. It applies to estates with a total value exceeding a certain threshold, which is currently set at $1 million. If the value of the estate is below this threshold, no estate tax is owed. However, if the value exceeds $1 million, the tax rate starts at 0.8% and increases gradually up to a maximum rate of 16%.

It is important to consult with an estate planning attorney or tax professional to fully understand the implications of the Massachusetts estate tax and to ensure that your estate plan is structured in a way that minimizes tax liability. By doing so, you can ensure that your loved ones receive the maximum benefit from your estate.

Understanding Inheritance Tax in Massachusetts

Inheritance tax is a tax that is imposed on the transfer of property or assets from a deceased person to their beneficiaries. It is important to understand how inheritance tax works in Massachusetts if you are a resident or if you are expecting to receive an inheritance in the state.

Unlike some other states, Massachusetts does not have a separate inheritance tax. Instead, it has an estate tax that is imposed on the total value of a deceased person’s estate. The estate tax is calculated based on the fair market value of the assets at the time of the person’s death.

It is important to note that not all estates are subject to the Massachusetts estate tax. There is a threshold, known as the “exemption amount,” which determines whether or not an estate is subject to the tax. As of 2021, the exemption amount in Massachusetts is $1 million.

If the total value of the estate is below the exemption amount, then no estate tax is owed. However, if the value of the estate exceeds the exemption amount, then the estate tax is calculated based on a progressive rate schedule. The tax rates range from 0.8% to 16%.

It is also worth mentioning that Massachusetts has a “portability” provision, which allows a surviving spouse to use any unused portion of their deceased spouse’s exemption amount. This means that if one spouse passes away and their estate is below the exemption amount, the unused portion can be transferred to the surviving spouse, effectively increasing their exemption amount.

It is important to consult with a qualified estate planning attorney or tax professional to fully understand the inheritance tax laws in Massachusetts and to ensure that you are in compliance with the regulations. They can provide guidance on estate planning strategies and help minimize the tax burden on your estate or inheritance.

What is an Inheritance Tax?

An inheritance tax is a tax that is imposed on the transfer of assets or property from a deceased person to their heirs or beneficiaries. It is different from an estate tax, which is a tax on the total value of a person’s estate at the time of their death. Inheritance tax is typically based on the value of the assets or property that is being transferred.

The purpose of an inheritance tax is to generate revenue for the government and to distribute wealth more evenly among the population. It is often seen as a way to prevent the concentration of wealth in the hands of a few individuals or families. Inheritance tax rates and exemptions vary from state to state, and some states may not have an inheritance tax at all.

Inheritance tax is typically paid by the heirs or beneficiaries of the deceased person’s estate. The tax is calculated based on the value of the assets or property that they receive. The tax rate may be a fixed percentage or it may be progressive, meaning that it increases as the value of the assets or property increases.

It is important to note that inheritance tax is different from gift tax. Gift tax is a tax that is imposed on the transfer of assets or property during a person’s lifetime. Inheritance tax is only applicable after a person’s death.

Overall, inheritance tax is a complex and often controversial topic. It is important for individuals to understand the inheritance tax laws in their state and to consult with a tax professional or estate planning attorney to ensure that they are in compliance with the law and to minimize their tax liability.

Is There an Inheritance Tax in Massachusetts?

When it comes to estate planning and the transfer of wealth, one important consideration is whether or not there is an inheritance tax in Massachusetts. An inheritance tax is a tax imposed on the assets and property that are passed down to beneficiaries after someone’s death.

In Massachusetts, the good news is that there is no inheritance tax. This means that beneficiaries who receive assets or property from a deceased individual are not required to pay a specific tax on those inheritances.

However, it is important to note that Massachusetts does have an estate tax. The estate tax is a tax imposed on the total value of a deceased individual’s estate, including both probate and non-probate assets. The estate tax is calculated based on the value of the estate and the applicable tax rates.

It is also worth mentioning that Massachusetts has certain exemptions and thresholds for the estate tax. For example, as of 2021, estates with a value of $1 million or less are exempt from the estate tax. Estates with a value above $1 million are subject to the tax, with rates ranging from 0.8% to 16%.

While there is no specific inheritance tax in Massachusetts, it is still important to consult with an estate planning attorney or tax professional to understand the implications of the estate tax and to ensure that your estate plan is structured in a way that minimizes tax liabilities for your beneficiaries.

Overall, Massachusetts does not have an inheritance tax, but it does have an estate tax that applies to certain estates. Understanding the intricacies of these taxes and seeking professional advice can help ensure that your assets are transferred efficiently and in accordance with your wishes.

How Does the Inheritance Tax Work in Massachusetts?

In Massachusetts, an inheritance tax is imposed on the transfer of assets from a deceased person to their beneficiaries. Unlike an estate tax, which is based on the total value of the deceased person’s estate, an inheritance tax is based on the individual beneficiaries’ share of the inheritance.

The inheritance tax in Massachusetts is calculated based on the fair market value of the inherited assets at the time of the deceased person’s death. The tax rate varies depending on the relationship between the deceased person and the beneficiary. Close relatives, such as spouses, parents, and children, are subject to lower tax rates or may be exempt from the inheritance tax altogether.

It’s important to note that Massachusetts is one of the few states that still imposes an inheritance tax. Many states have abolished this tax or have replaced it with an estate tax. However, Massachusetts continues to levy an inheritance tax on certain transfers of wealth.

When a person passes away in Massachusetts, the executor or personal representative of the estate is responsible for filing an inheritance tax return with the Massachusetts Department of Revenue. This return must be filed within nine months from the date of death. The tax owed must also be paid within this timeframe.

If the inheritance tax is not paid within the specified timeframe, interest and penalties may be assessed. It’s important for the executor or personal representative to accurately calculate the tax owed and ensure timely payment to avoid any additional financial burdens.

It’s worth noting that certain assets may be exempt from the inheritance tax in Massachusetts. These exemptions include life insurance proceeds, retirement accounts, and property held in a trust. Additionally, certain transfers to charitable organizations may also be exempt from the inheritance tax.

Exemptions and Rates for Inheritance Tax in Massachusetts

When it comes to inheritance tax in Massachusetts, there are certain exemptions and rates that you should be aware of. These exemptions determine whether or not you will be subject to paying the tax, and the rates determine how much you will have to pay.

Firstly, it’s important to note that Massachusetts does not have a separate inheritance tax. Instead, it has an estate tax, which is imposed on the value of the decedent’s estate. This means that the tax is paid by the estate itself, rather than the individual beneficiaries.

There are certain exemptions from the Massachusetts estate tax. For example, if the value of the estate is below a certain threshold, no tax is owed. As of 2021, the threshold is $1 million. This means that if the value of the estate is less than $1 million, no estate tax is owed.

In addition to the threshold exemption, there are also certain deductions that can be applied to reduce the taxable value of the estate. These deductions include funeral expenses, administration expenses, and debts of the decedent.

The rates for the Massachusetts estate tax vary depending on the value of the estate. The tax rates range from 0.8% to 16%. The highest rate of 16% is applied to estates with a value of $10 million or more.

It’s important to note that the estate tax in Massachusetts is progressive, meaning that the tax rate increases as the value of the estate increases. This ensures that higher-value estates pay a higher rate of tax.

Exemptions from Inheritance Tax in Massachusetts

In Massachusetts, there are certain exemptions from the inheritance tax that can help reduce the tax burden on beneficiaries. These exemptions are designed to protect certain types of assets and ensure that they can be passed on to heirs without incurring a tax liability.

One of the main exemptions from inheritance tax in Massachusetts is the exemption for assets passing to a surviving spouse. When a spouse inherits assets from their deceased partner, they are not subject to the inheritance tax. This exemption recognizes the importance of providing for a surviving spouse and allows them to inherit assets without any tax consequences.

Another exemption from inheritance tax in Massachusetts is the exemption for assets passing to charitable organizations. When assets are left to a qualified charitable organization, they are not subject to the inheritance tax. This exemption encourages philanthropy and allows individuals to support causes they care about without incurring a tax liability.

Additionally, there is an exemption for assets passing to certain types of trusts. If assets are left to a trust that meets certain requirements, they may be exempt from the inheritance tax. This exemption recognizes the importance of estate planning and allows individuals to pass on assets to future generations in a tax-efficient manner.

It is important to note that these exemptions may have certain limitations and requirements. For example, the exemption for assets passing to a surviving spouse may only apply if the spouse is a U.S. citizen. Additionally, the exemption for assets passing to charitable organizations may require that the organization is recognized as a tax-exempt entity by the IRS.

Overall, the exemptions from inheritance tax in Massachusetts provide important protections for certain types of assets and beneficiaries. By understanding these exemptions, individuals can plan their estates in a way that minimizes the tax burden on their loved ones.

Rate of Inheritance Tax in Massachusetts

In Massachusetts, the rate of inheritance tax varies depending on the relationship between the deceased person and the beneficiary. The tax rates range from 0% to 16%. Here is a breakdown of the different tax rates:

| Relationship to the Deceased | Tax Rate |

|---|---|

| Spouse, parents, children, or grandchildren | 0% |

| Siblings | 0.8% |

| All other beneficiaries | 16% |

It’s important to note that Massachusetts does not have a separate inheritance tax for non-residents. The tax rates apply to both residents and non-residents alike.

Additionally, Massachusetts does not impose an estate tax, which is different from an inheritance tax. Estate tax is based on the total value of the deceased person’s estate, while inheritance tax is based on the individual beneficiaries’ share of the inheritance.

When calculating the inheritance tax, the value of the inherited property is determined at its fair market value at the time of the deceased person’s death. The tax is then calculated based on the applicable tax rate for each beneficiary.

It’s important to consult with a qualified tax professional or attorney to ensure compliance with Massachusetts inheritance tax laws and to understand any potential exemptions or deductions that may apply to your specific situation.

Question-answer:

What is an inheritance tax?

An inheritance tax is a tax imposed on the assets that are inherited by an individual after someone’s death.

Does Massachusetts have an inheritance tax?

No, Massachusetts does not have an inheritance tax.

Are there any taxes on inherited property in Massachusetts?

No, there are no taxes on inherited property in Massachusetts.

What are the tax laws regarding inheritance in Massachusetts?

In Massachusetts, there is no inheritance tax, but there may be federal estate taxes for estates with a value over a certain threshold.

What is the threshold for federal estate taxes in Massachusetts?

The threshold for federal estate taxes in Massachusetts is $11.7 million for individuals and $23.4 million for married couples in 2021.