- Understanding Inheritance Tax in Georgia

- What is Inheritance Tax?

- How Does Inheritance Tax Work in Georgia?

- Are There any Exemptions or Deductions?

- Is There an Inheritance Tax in Georgia?

- Current Status of Inheritance Tax in Georgia

- Question-answer:

- What is an inheritance tax?

- Does Georgia have an inheritance tax?

- Are there any taxes on inherited property in Georgia?

- What are the tax implications of inheriting money in Georgia?

- Do I need to pay taxes on inherited assets in Georgia?

- What is an inheritance tax?

- Does Georgia have an inheritance tax?

When it comes to estate planning, one of the key considerations is whether or not there is an inheritance tax in the state where you reside. In the case of Georgia, the good news is that there is no inheritance tax. This means that when you pass away, your heirs will not be required to pay a tax on the assets they inherit from you.

It’s important to note, however, that while Georgia does not have an inheritance tax, it does have an estate tax. The estate tax is a tax on the total value of a person’s estate at the time of their death. In Georgia, the estate tax only applies to estates with a value of $5.49 million or more. If your estate is below this threshold, you will not be subject to the estate tax.

Another important point to consider is that even if your estate is subject to the estate tax, there are certain exemptions and deductions that may apply. For example, there is a marital deduction that allows a surviving spouse to inherit an unlimited amount of assets without being subject to the estate tax. Additionally, there is a charitable deduction that allows for a reduction in the taxable value of an estate if a certain portion is left to a qualified charity.

Understanding Inheritance Tax in Georgia

Inheritance tax is a tax that is imposed on the transfer of assets or property from a deceased person to their heirs or beneficiaries. It is important to understand how inheritance tax works in Georgia to ensure that you are prepared and can make informed decisions regarding your estate planning.

In Georgia, there is currently no inheritance tax. This means that when someone passes away, their heirs or beneficiaries do not have to pay any taxes on the assets or property they receive. This is different from other states in the United States that do have an inheritance tax.

However, it is important to note that even though there is no inheritance tax in Georgia, there may still be other taxes that need to be considered. For example, there may be federal estate taxes or state estate taxes that apply depending on the value of the estate. It is recommended to consult with a tax professional or estate planning attorney to understand the specific tax implications in your situation.

It is also important to understand that inheritance tax and estate tax are not the same. Estate tax is a tax that is imposed on the total value of a person’s estate after they pass away, whereas inheritance tax is imposed on the individual beneficiaries or heirs who receive the assets or property.

Overall, understanding inheritance tax in Georgia is crucial for effective estate planning. While there is currently no inheritance tax in the state, it is still important to consider other potential taxes and consult with professionals to ensure that your estate is handled properly and in accordance with the law.

What is Inheritance Tax?

Inheritance tax, also known as estate tax or death tax, is a tax imposed on the transfer of assets from a deceased person to their heirs or beneficiaries. It is a tax on the right to transfer property upon death and is based on the value of the assets inherited.

The purpose of inheritance tax is to generate revenue for the government and to redistribute wealth. It is a way for the government to collect taxes on the transfer of wealth from one generation to the next.

Inheritance tax is different from estate tax, which is a tax on the total value of a deceased person’s estate. Inheritance tax is levied on the individual beneficiaries who receive the assets, while estate tax is paid by the estate itself before distribution to the beneficiaries.

The rate of inheritance tax varies depending on the jurisdiction and the value of the assets inherited. Some countries have a progressive tax system, where the tax rate increases as the value of the inheritance increases. Other countries have a flat tax rate for inheritance.

It is important to note that not all countries have inheritance tax. Some countries, such as the United States, have estate tax instead of inheritance tax. In these countries, the tax is paid by the estate before distribution to the beneficiaries.

Inheritance tax can be a complex and controversial topic, as it involves the transfer of wealth and the redistribution of assets. It is important for individuals to understand the inheritance tax laws in their jurisdiction and to plan their estate accordingly to minimize the tax burden on their heirs.

How Does Inheritance Tax Work in Georgia?

Inheritance tax is a tax that is imposed on the transfer of assets from a deceased person to their heirs. In Georgia, however, there is no inheritance tax. This means that when someone passes away and leaves assets to their beneficiaries, those beneficiaries do not have to pay any taxes on the inheritance they receive.

This is different from estate tax, which is a tax on the total value of a deceased person’s estate. Estate tax is paid by the estate itself, not the beneficiaries. Georgia also does not have an estate tax, so beneficiaries do not have to worry about paying taxes on the value of the estate they inherit.

It is important to note that even though Georgia does not have an inheritance tax or estate tax, there may still be other taxes that need to be paid when inheriting assets. For example, if the deceased person had investments that generated income, the beneficiaries may have to pay income tax on that income. Additionally, if the assets being inherited are sold, there may be capital gains tax on any profit made from the sale.

Overall, the absence of inheritance tax in Georgia is beneficial for beneficiaries, as they do not have to worry about paying additional taxes on the assets they inherit. However, it is still important to consult with a tax professional to understand any other tax obligations that may arise from inheriting assets.

Are There any Exemptions or Deductions?

When it comes to inheritance tax in Georgia, there are certain exemptions and deductions that can help reduce the tax burden on beneficiaries. These exemptions and deductions are designed to provide relief for specific situations and individuals.

One common exemption is the spouse exemption. In Georgia, if the deceased person leaves their entire estate to their spouse, no inheritance tax will be imposed. This exemption recognizes the importance of providing financial security for the surviving spouse.

Another exemption is the charitable deduction. If the deceased person leaves a portion of their estate to a qualified charitable organization, that portion may be deducted from the taxable value of the estate. This encourages philanthropy and supports the work of charitable organizations in Georgia.

Additionally, there is a family exemption available in Georgia. This exemption allows a certain amount of the estate to be passed on to family members without incurring inheritance tax. The specific amount of the exemption may vary depending on the relationship between the deceased person and the beneficiary.

It’s important to note that these exemptions and deductions may have certain limitations and requirements. For example, the charitable deduction may only apply to organizations that meet specific criteria set by the state. It’s advisable to consult with a tax professional or attorney to fully understand the eligibility and application of these exemptions and deductions.

Overall, the presence of exemptions and deductions in Georgia’s inheritance tax system helps to ensure that the tax burden is fair and reasonable for beneficiaries. These provisions recognize the importance of certain relationships and contributions to society, providing relief in specific circumstances.

Is There an Inheritance Tax in Georgia?

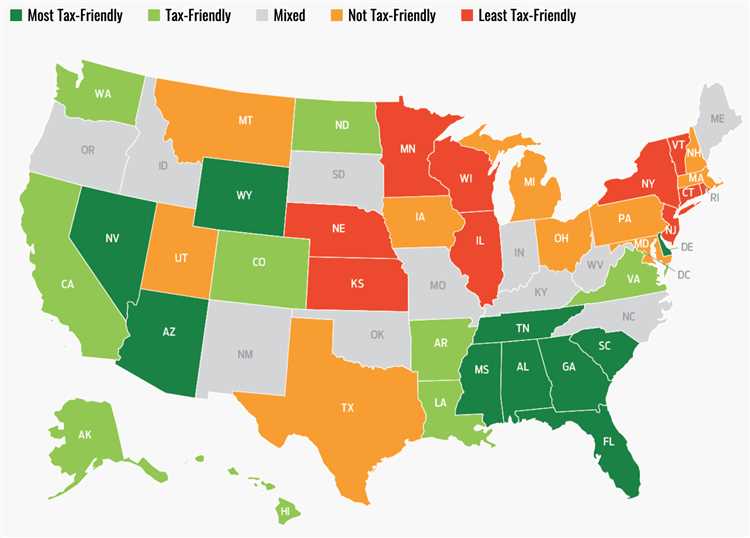

When it comes to inheritance tax, Georgia is one of the few states in the United States that does not impose this type of tax. This means that individuals who inherit assets or property from a deceased person in Georgia do not have to pay any inheritance tax on those assets.

This is good news for individuals who are planning their estate or who are beneficiaries of an estate in Georgia. Unlike some other states, Georgia does not have a separate tax on the transfer of assets after death.

However, it is important to note that while Georgia does not have an inheritance tax, it does have an estate tax. The estate tax is a tax on the total value of a person’s estate at the time of their death. This tax is paid by the estate itself, not by the individual beneficiaries.

It is also worth mentioning that the estate tax in Georgia only applies to estates with a value exceeding a certain threshold. As of 2021, the threshold for the Georgia estate tax is $5.49 million. This means that if the total value of an estate is below this threshold, no estate tax is owed.

Overall, while Georgia does not have an inheritance tax, it does have an estate tax that applies to larger estates. It is important for individuals who are planning their estate or who are beneficiaries of an estate in Georgia to be aware of these tax implications and consult with a professional to ensure compliance with the state’s tax laws.

Current Status of Inheritance Tax in Georgia

As of now, Georgia does not have an inheritance tax. This means that individuals who inherit property or assets from a deceased person are not required to pay any taxes on the inheritance.

The absence of an inheritance tax in Georgia is beneficial for individuals who are planning their estate or who may be receiving an inheritance. It allows for a smoother transfer of wealth and assets without the burden of additional taxes.

However, it is important to note that while Georgia does not have an inheritance tax, there may still be other taxes and fees associated with the transfer of assets. For example, there may be estate taxes or gift taxes that need to be considered.

It is always recommended to consult with a qualified tax professional or estate planning attorney to fully understand the tax implications of any inheritance or estate planning decisions in Georgia.

It is also worth noting that tax laws can change over time, so it is important to stay informed about any updates or changes to the inheritance tax laws in Georgia.

Overall, the current status of inheritance tax in Georgia is that it does not exist. However, it is important to stay informed and seek professional advice to ensure compliance with any applicable tax laws.

Question-answer:

What is an inheritance tax?

An inheritance tax is a tax imposed on the transfer of assets from a deceased person to their heirs or beneficiaries.

Does Georgia have an inheritance tax?

No, Georgia does not have an inheritance tax. Inheritance taxes are not levied on assets transferred from a deceased person to their heirs or beneficiaries in Georgia.

Are there any taxes on inherited property in Georgia?

No, there are no taxes on inherited property in Georgia. Inherited property is not subject to any taxes or fees in the state.

What are the tax implications of inheriting money in Georgia?

Inheriting money in Georgia does not have any tax implications. The money received as an inheritance is not considered taxable income and does not need to be reported on the recipient’s tax return.

Do I need to pay taxes on inherited assets in Georgia?

No, you do not need to pay taxes on inherited assets in Georgia. Inherited assets, such as real estate or investments, are not subject to any taxes or fees in the state.

What is an inheritance tax?

An inheritance tax is a tax imposed on the transfer of assets from a deceased person to their heirs or beneficiaries.

Does Georgia have an inheritance tax?

No, Georgia does not have an inheritance tax. Inheritance taxes are not levied on assets transferred through inheritance in the state of Georgia.